Will PPP Be Dethroned?

While PPP is by far the favorite metric for partners and other recruiter shops, all partners will be better off examining the data more closely before shooting their business plan and résumé out to a low-paying firm.

Michael Allen

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. Michael Allen is Managing Principal at Lateral Link, focusing exclusively on partner placements with Am Law 200 clients and placements for in-house attorneys.

When it comes to partner moves, few metrics are tossed around more liberally than PPP, which seems to offer partners the ability to ballpark compensation. The idea is that this simple metric will help partners identify firms with the highest profitability for their practices. However, PPP is not all that important for many partners when it comes to finding the best platforms.

At Lateral Link, we use a metric that we (and several others partners) refer to as PPM or rather, Profits Per Me. PPM is primarily concerned with three key areas: a sliding scale for compensation on business generations (originations and servicing), blended-rates, and platform compatibility. PPM is used to find the firm that makes the most financial sense for a partner — from service-partner to rainmaker.

Rainmakers usually pose the greatest challenge in finding a suitable lateral destination. Though most firms have the appetite to integrate a rainmaker’s portable business, few have the platform, cash reserves, or compensation structure to entice these heavyweight partners. PPP can be especially ineffective in finding firms for rainmakers.

Averages can be useful but partners want to know how these profits are dispersed. Is the firm top heavy with a small “middle class,” is there extreme parity centered around the mean profits, or is the firm evenly distributed through all levels? Think of a balloon with only so much air. You squeeze one side, and the air goes to the other side. Firms have only so much top line revenue, so the question is how is it distributed after costs?

This graph succinctly illustrates how two curves can have the same PPP but a wildly different concentration of individual partner profits. Instead, the standard deviation of individual partner profits added, or compensation, would be more beneficial, however that data is nearly impossible to obtain. Instead we rely on a metric we call the Partner Gini Ratio.

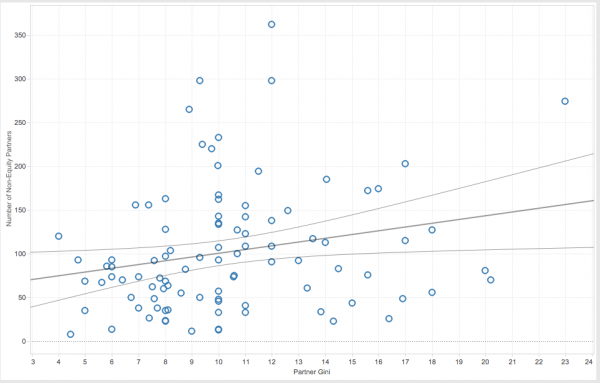

The many of you who were political science majors will remember the Gini Ratio as a measure of inequality. Our ratio is slightly less scientific — ALM provides the spread between the lowest paid partner at a firm and the highest paid partner, which we use as our Gini Ratio. On average, the highest paid partner makes ten times as much as the lowest paid partner for this large sample of Am Law 200 firms. If you were wondering if PPP had any influence on this ratio, you missed the fairway and landed in the parking lot. PPP accounted for 2.3% of the variance in our Gini Ratio, a less than negligible amount. We ran all the standard Am Law 200 metrics through a simple regression analysis and the only metric with any non-negligible correlation to our Gini Ratio was the number of non-equity partners, which usually means service-partners, unless we are talking about those who have a special contract given seniority at the firm.

In retrospect, it is unsurprising that the number of non-equity partners had the strongest correlation to our Gini Ratio. Firms often utilize non-equity partners to help service large books of business, so the higher the number of service partners, the more concentrated or monopolized are the books of business at a firm with rainmakers — unless the firm had an unusual dichotomy of mid-level equity partners and services partners only. Similarly, the greater the supply of service partners a firm has, the less leverage, and ultimately compensation, a service partner can expect — leaving more for the rainmakers. The number of equity partners has a correlation coefficient of .28, meaning there is a weak but pronounced correlation between the two metrics.

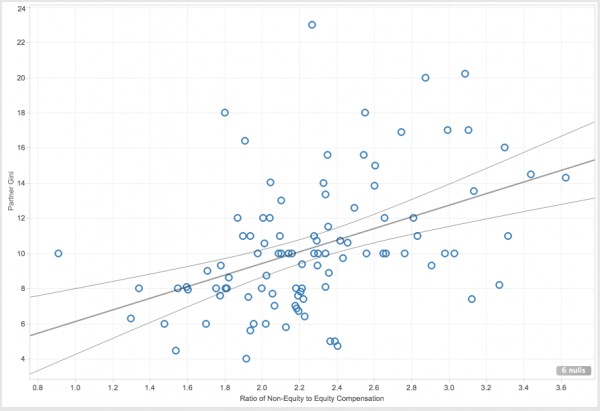

In search of a better metric, we manipulated the Am Law numbers to calculate PPNP — Profits Per Non-Equity Partners. We then calculated the ratio between PPP and PPNP and compared these two new metrics to see what influence they might have on our Gini Ratio. Unsurprisingly, the PPP/PPNP metric correlated highly with the Gini Ratio. It had a correlation coefficient of .43, meaning it had a fairly strong influence on the variance in our Gini Ratio.

Why should this matter to you? When rainmakers move to a new firm, their PPM is calculated differently than any other partner. For partners with over $10 million in portable business, their book is largely serviced by service-partners and associates. The less these service-partners and associates bill, the less you get paid.

Let us note quickly that we are not arguing for increased law firm inequality, we are merely observing what is on the mind of most partners when considering a lateral move – PPM.

Also affecting a rainmaker’s bottom line is the compensation split to associates and service-partners. Rainmakers don’t necessarily want firms with the highest PPP for these are seldom the firms with the highest Gini Ratio, meaning their take home is dampened by, well, equality. Often firms with low PPP’s are able to pay more than firms with twice their PPP simply because of their firm structure.

Conversely, service-partners or equity partners who service their own books — with the help of one or two associates — will want to seek a firm with more income parity. Even if you source your own work without relying on a rainmaker, you will often still feel the effects of lateral incentives, guaranteed compensation, and large bonuses used to entice rainmakers, draining from your coffers.

Similarly, this is not always a question of PPP. Your PPM is dependent on several factors, including rate sensitivity and the firm’s platform.

For robust partners who don’t quite hit rainmaker status, firms with a medium spread are not necessarily ideal. The structure of your business heavily influences the type of firm that you want to seek out. If your business relies heavily on associates, you want to seek out a firm that bills associates out at a high rate; because associate salaries are largely static, the extra profit often slips back into your pocket. PPP is not always the best indicator of this because it measures the firm’s bottom line, not your own. The higher the PPP, the less you may actually take home, as the firm is pocketing a higher percentage as their own profit.

While PPP is by far the favorite metric for partners and other recruiter shops, all partners will be better off examining the data more closely before shooting their business plan and résumé out to a low-paying firm. The process often requires a significant amount of time and experience, so give us a call and we’d be happy to help you expedite your search.

![]() Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.