New Student Loan Rates For Law Students

New student loan interest rates announced. Are they lower or higher?

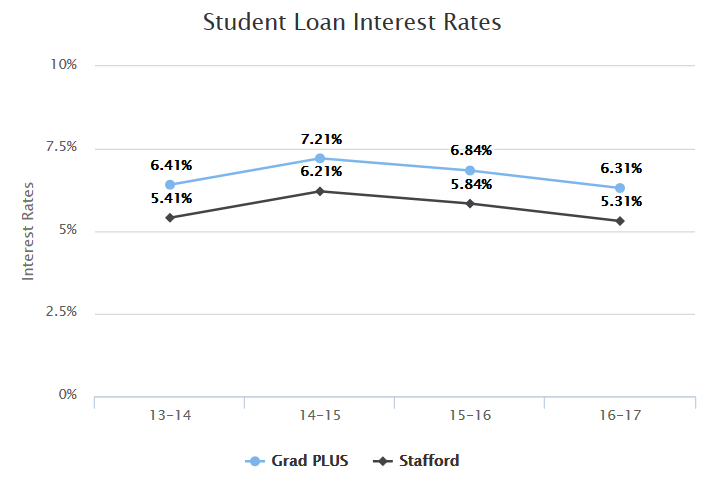

Last week, the federal government set new student loan interest rates for law students for the 2016-17 school year. Since 2013, the rates are based on the 10-year U.S. Treasury note auction. These rates have fallen in the last two years to the lowest amount since Congress debated and passed the new student loan law.

Last week, the federal government set new student loan interest rates for law students for the 2016-17 school year. Since 2013, the rates are based on the 10-year U.S. Treasury note auction. These rates have fallen in the last two years to the lowest amount since Congress debated and passed the new student loan law.

Law students attending school at least half-time have two types of loans available directly from the Department of Education. Students may borrow up to $20,500 each year of Stafford loans at a rate equal to the 10-year Treasury yield plus 3.6% (capped at 9.5%). The rate for the 2016-2017 academic year is 5.31%.

Generative AI In Legal Work — What’s Fact And What’s Fiction?

The second type — Grad PLUS loans — has no limits and students may borrow up to the cost of attendance less any other financial aid they have secured. The interest rate is 1% higher than the Stafford counterpart (capped at 10.5%). The Grad PLUS rate for the 2016-2017 academic year is 6.31%.

So what’s the practical impact of these changes?

Importantly, there are no interest subsidies for either type of loan. Interest accrues from the time the loan is disbursed until the time the loan is repaid in full. Monthly payment and cumulative payments over the life of the loan depend on the rate.

This is best illustrated through an example. Imagine a student starting at Arizona Summit this fall. Over the past five years, the school has increased tuition an average of 3.87% per year to $43,966 in 2015-16. Someone who starts in 2016, borrows the full amount allowed, and graduates after three years will owe $245,041 when their first payment is due.

This is best illustrated through an example. Imagine a student starting at Arizona Summit this fall. Over the past five years, the school has increased tuition an average of 3.87% per year to $43,966 in 2015-16. Someone who starts in 2016, borrows the full amount allowed, and graduates after three years will owe $245,041 when their first payment is due.

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Generative AI In Legal Work — What’s Fact And What’s Fiction?

The Business Case For AI At Your Law Firm

The Business Case For AI At Your Law Firm

That figure assumes a 3.87% tuition hike each year, an annual 2% cost of living increase, no tuition discounts, no pre-payments, and no interest rate changes for three years. About 40% of the class paid full sticker last year at Arizona Summit.

Using the interest rate from two years ago — the high point since Congress passed the new law — the student would owe $249,013 when the first payment is due, or about $4,000 more. Overall, the lower rates put about $160 more per month in this borrower’s pocket. Over the life of the loan, that adds up to $19,000 in savings on the 10-year plan and $38,500 on the 20-year plan.

Using the interest rate from two years ago — the high point since Congress passed the new law — the student would owe $249,013 when the first payment is due, or about $4,000 more. Overall, the lower rates put about $160 more per month in this borrower’s pocket. Over the life of the loan, that adds up to $19,000 in savings on the 10-year plan and $38,500 on the 20-year plan.

So these new rates are good news for students, but the news is not that great. Debt payments get more manageable and grow at a slower pace. But, at these borrowing levels, even with a New York City biglaw salary, it’s tough.

Although much political hay was made of the student loan interest rates in 2013, student loan advocates had only a minor win. The problem is tuition, and the current borrowing program does not exert any downward pressure on schools at all. Fundamental changes to the program are needed for that.

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Legal AI: 3 Steps Law Firms Should Take Now

Kyle McEntee is the executive director of Law School Transparency, a 501(c)(3) nonprofit with a mission to make entry to the legal profession more transparent, affordable, and fair. LST publishes the LST Reports and produces I Am The Law, a podcast about law jobs. You can follow him on Twitter @kpmcentee and @LSTupdates.