The End Of The 'Partner' Era

Lateral moves are no longer a bottom-line bonus, but a requisite for competing in the modern legal market.

Michael Allen

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. Michael Allen is Managing Principal at Lateral Link, focusing exclusively on partner placements with Am Law 200 clients and placements for in-house attorneys.

The Am Law 200 law firms rarely witness partners with “lifer” mentalities anymore. As the lateral market has become more opaque and clients more mobile, and as firms chase metrics, we expect to see very few partners stay with their firm long-term.

Over the last eight years, over 50% of Biglaw partners have lateraled firms at least once. Those who last moved 5-6 years ago are the most likely to move again based on sample data from 2015 lateral moves. As an attorney becomes more displaced from his last lateral move, his likelihood of moving increases fairly linearly. The exception to this rule is a partner within one year of his last move.

Movement rates spike in the first year of an attorney’s lateral move. To recruiters, this is unsurprising; what might have seemed like a perfect marriage of attorney and firm can swiftly fall apart once the partnership is consummated. The impetus for these first-year moves are often either financial or personal; a partner may have overpromised and under-delivered respective to their projections during the lateral process, a firm may have hyperbolized its platform or overstated its capabilities, or it can simply be a case of culture shock or coworker compatibility.

After the first year, rates of movement steadily increase until they hit a second peak in the fifth year. Based on the collected data, partners making a move last moved five years ago, on average. Because of relative population sizes, in terms of volume, most lateral partner moves are made by those who have not moved in the past five years. However, the data suggests that firms that added partners in 2011 — five years ago — will see lateral attrition at a much higher relative rate than normal.

The firms at the top of this list are largely unsurprising; this Who’s Who of the largest firms features few surprising names. DLA Piper’s modest loss of lateral partners since January backs our assumptions. Fifty percent of the partners had moved in the last eight years, with most moving either one year ago, or five years ago.

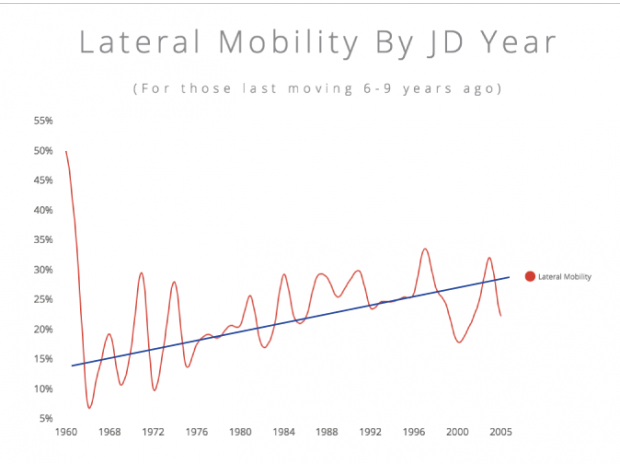

This trend is not uniform, however; JD year plays a significant role in predicting who will move. Based on the analysis of 2015’s lateral moves, there is a strong upwards trend in lateral movement the more junior a partner is. The correlation coefficient between JD and movement rates is .2, a fairly pronounced correlation.

This trend is not surprising. As partners push up against mandatory retirement ages, their practices become less mobile. For those waiting too long, it can become extraordinarily difficult to secure another partnership position after they have been de-equitized.

The dip in the movement rates for late ’90s and early ’00s grads represents a mobility trap in the life of a partner. Many of these partners are newly equitized, and they are in the process of accreting portable business. Many of the early- to mid-2000 grads are non-equity partners and face less scrutiny over their portable business. Attorneys from the early- to mid-’90s have had years to secure new clients and build up their portable business, making them more attractive lateral prospects. Without this dip in lateral mobility, the correlation between JD year and movement rates would have been even more pronounced.

The marginalization of the old partnership model has transformed the partner market on the firm level from an autarky to an open economy — similar to sports teams these days, we see fewer lifers like Magic and Bird and more journeymen like Jason Kidd and Dwight Howard.

Lateral moves are no longer a bottom-line bonus, but a requisite for competing in the modern legal market. Firms are starting to make use of analytics to keep their partnership stock steady. Firms that binged on lateral hires in certain years will have to plan ahead to offset the losses they will likely incur five years down the line.

Our job at Lateral Link is to understand the market and respond to trends before firms find themselves in a pinch. We typically approach decision makers before they ask for assistance because we already understand the situation they face given market intelligence and data. In a way, we act as merchant bankers — in the historical sense — and we are happy to help you analyze and quell your lateral leakages before you start to notice them; once you start noticing losses, it’s often too late.

![]() Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.