What Are Donald Trump's Plans For Law School Debt?

How are you going to tackle your debt after graduation? We seriously hope you have a plan.

Now that the election has come and gone, it’s a great time to talk about law students and the crippling debt they’ll have to face head-on and attempt to pay down in the years to come. About two million Americans owe at least $100,000 in student debt, and according to the most recent figures available, the average law school graduate borrowed about $140,616 to finance their degree. It’s understandable that deeply indebted young lawyers would want to know what the president-elect has planned for their repayment options.

Now that the election has come and gone, it’s a great time to talk about law students and the crippling debt they’ll have to face head-on and attempt to pay down in the years to come. About two million Americans owe at least $100,000 in student debt, and according to the most recent figures available, the average law school graduate borrowed about $140,616 to finance their degree. It’s understandable that deeply indebted young lawyers would want to know what the president-elect has planned for their repayment options.

If you’d like to take a look at what your future may hold, check out this compilation of the average indebtedness of 2015 graduates who incurred law school debt, ranked by law school from highest to lowest, courtesy of U.S. News. There, you will see some truly frightening numbers — but perhaps they don’t seem so bad to you because after all, you think you’ll get a job that will pay well enough to service six figures of debt.

We all were once that optimistic about our law school debt. Maybe you will be able to land that high-paying job… but maybe you won’t. The employment market for new law school graduates has “improved” on its face, but that’s only because there have been fewer graduates to employ. We hope there will be actual improvements by the time you graduate, but even so, you’ll still have all of that debt to worry about.

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

For many, many recent law school graduates, income-based repayment plans are what make loan repayment possible in the first place. Will these programs — IBR, PAYE, and PSLF — remain intact during a Trump presidency?

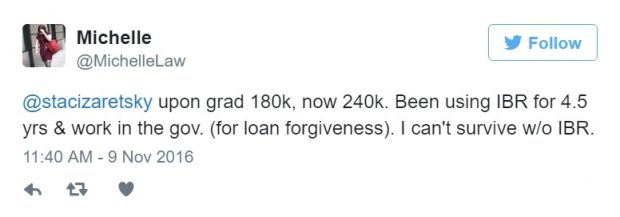

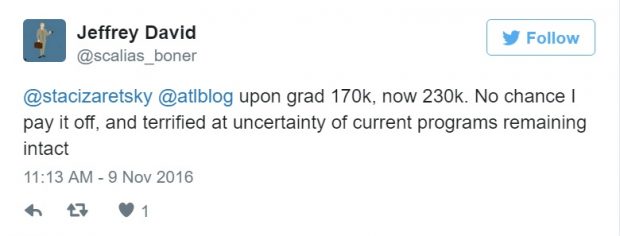

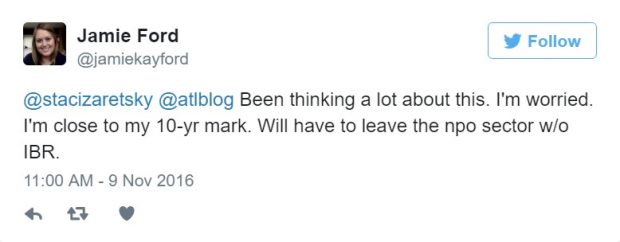

We reached out to our vast network of Twitter followers — largely composed of lawyers, law students, and legal professionals — to ask them the following four questions:

1) How much law school debt do you have?

2) Will IBE/PAYE remain options under President Trump?

3) Do you think you’ll ever pay it off?

4) Why?

Here are a few of the responses we received. Many lawyers are completely reliant on income-based repayment and public service loan forgiveness to repay their debts.

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Legal AI: 3 Steps Law Firms Should Take Now

The Business Case For AI At Your Law Firm

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

As it turns out, President-elect Trump — a man who ran his own for-profit “college” — has claimed to support income-based loan repayment plans. During a speech given in October, he even went so far as to propose an income-based repayment plan that is more generous than those that are currently offered. From TIME Money:

Under his proposal, graduates would pay 12.5% of their income for 15 years, after which the remaining balance would be forgiven. “You graduate from college and you’re starting out with like an anchor around your neck,” he said in the speech. “No good. It’s no good.”

More than 5 million borrowers are currently enrolled in an income-driven repayment plan, a number that’s surged in recent years. Yet the earliest you currently can have debt forgiven under those plans is 20 years.

Under IBR, the earliest you can have your debt forgiven is 25 years. Under PAYE, the earliest you can have your debt forgiven is 20 years. Under PSLF, the earliest you can have your debt forgiven is 10 years. Unfortunately, Trump seemed to hint that he may completely eliminate PSLF — a program where loans forgiven are not considered taxable income — perhaps if only to get everyone on the same repayment scheme.

As for those who are waiting for their loans to be forgiven under IBR or PAYE, here’s some information from the FinAid website:

The maximum repayment period is 25 years. After 25 years, any remaining debt will be discharged (forgiven). Under current law, the amount of debt discharged is treated as taxable income, so you will have to pay income taxes 25 years from now on the amount discharged that year.

Law students, if you’re planning to rely on the loan forgiveness associated with income-driven repayment, then you should be praying that the government decides to do away with that ticking tax time bomb, or else you’ll likely be in just as bad of a place as far as debt is concerned — unless, of course, you’re willing to file for bankruptcy later in life.

How are you going to tackle your law school debt? We seriously hope you have a plan.

Staci Zaretsky is an editor at Above the Law. She’d love to hear from you, so feel free to email her with any tips, questions, or comments. You can follow her on Twitter or connect with her on LinkedIn.

Staci Zaretsky is an editor at Above the Law. She’d love to hear from you, so feel free to email her with any tips, questions, or comments. You can follow her on Twitter or connect with her on LinkedIn.