Money

-

Money

MoneyFrom Fudging The Numbers To Just Deserts

Know what's worse than a lawyer who's bad with numbers? A bookkeeper that's unethical with them. -

Money

MoneyLaw Professor Pinpoints Elon Musk's Latest Problem: Cash

Wu-Tang said it best: cash rules everything around me.  Sponsored

SponsoredIs The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The rise of remote work has dramatically reshaped the relationship between Lawyers and Law Firms, see how Scale LLP has taken the steps to get…-

-

Money

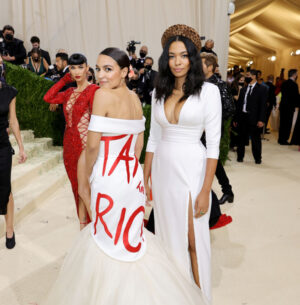

MoneyAOC Presses Biden To Cover All Of Cost Like He Said He Would

Once we figure out this undergrad debt stuff, let's get on the grad school bill too. WashU ain't cheap. -

Money

MoneyLawyers Deserve Raises: Median Salary Has Taken A Dive Over The Last Two Decades

Being a lawyer is not as lucrative as it once was. -

Money

MoneyEight Billion Dollars? A Lawsuit Over EIGHT BILLION DOLLARS?!

Crime pays, but with prices like these, where is the nearest studio? -

Money, Sponsored Content

Money, Sponsored ContentThe Benefits From A Small Business Credit Card

Earn up to $750 bonus cash back with the right Business Credit Card. -

Sponsored

SponsoredThe Business Case For AI At Your Law Firm

ChatGPT ushers in the age of generative AI – even for law firms.-

Money

MoneyFewer Things Harder To Pass Up Than Getting Your Cash Up!

Who said you need to work at a big firm to get the big bucks? -

-

Money

MoneySomeone Should Have Told Elon That 'Dank Memes' Are Not An Affirmative Defense

No Patrick, purchase offers of knick-knacks at $694.20 is not as funny as you think it is. -

Money, Sponsored Content

Money, Sponsored ContentDismantling The Gender Pay Gap: The Role Of Non-Promotable Tasks

When these tasks and the time they require are added up, they put the women doing them at a significant disadvantage. -

Money

MoneyIf You Want Big Money As A Lawyer, You Should Avoid This State

Not every lawyer will make six figures.

Sponsored

Sponsored

Legal AI: 3 Steps Law Firms Should Take Now

If 2023 introduced legal professionals to generative AI, then 2024 will be when law firms start adapting to utilize it. Things are moving fast, so…

Sponsored

The Business Case For AI At Your Law Firm

The Business Case For AI At Your Law Firm

ChatGPT ushers in the age of generative AI – even for law firms.

Sponsored

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

How to best leverage generative AI as an early adopter with ethical use.

Sponsored

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The rise of remote work has dramatically reshaped the relationship between Lawyers and Law Firms, see how Scale LLP has taken the steps to get…

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

In this CLE-eligible webinar, we’ll explore the most common accounting pitfalls and how to avoid them for your firm.

-

-

Biglaw, Bonuses, Money

Biglaw, Bonuses, MoneyCrush Those Wednesday Worries With A Cash Stack!

Pay like this makes me wonder if I should get into Biglaw. -

Law Schools, Money

Law Schools, MoneyBar Tabs: Let's Talk About Debt, Baby!

I know you don't want to think about this until May 1st, but some things are better with no chaser. -

-

Money

MoneyLitigation Firm Wows With Bonuses That Average Way Above Biglaw

Bigger than Biglaw where it counts. -

Biglaw, Money

Biglaw, MoneyTotally Not A Magic Circle Firm Just Showed Its Hand

And for my next trick, more pro bono hours! -

Biglaw, Bonuses, Money

Biglaw, Bonuses, MoneyCircle Up For This Bonus Announcement, It's Magical

Do you believe in magic, associates?