Wall Street

-

Biglaw, General Counsel, In-House Counsel, Technology

Biglaw, General Counsel, In-House Counsel, Technology5 Ways In Which The Business Of Law Is NOT Changing Anytime Soon

Are we experiencing, or about to experience, a revolution in the world of legal services? Slow your roll.... -

Trials, Wall Street

Trials, Wall StreetNomura Bond Traders’ Real Crime Was Corrupting America’s Youth

Won’t somebody please think of the children?  Sponsored

SponsoredLegal AI: 3 Steps Law Firms Should Take Now

If 2023 introduced legal professionals to generative AI, then 2024 will be when law firms start adapting to utilize it. Things are moving fast, so…-

Banking Law, Wall Street

Banking Law, Wall StreetDeutsche Bank To Former Board Members: These Absurdly Expensive Fines Ain’t Just Gonna Pay Themselves

The House of Cryan is attempting to create the politely Lutheran clawback.

-

Money, Securities Law, Small Law Firms, Wall Street

Money, Securities Law, Small Law Firms, Wall StreetLooking Back On A Year Of Crowdfunding

What are the pros and cons of crowdfunding for startup companies seeking capital? -

Television

TelevisionStandard Of Review: Raising A Glass Of Ice Juice To Billions's Excellent Second Season

In the second season, Billions moved from a show that was fine to a show that I looked forward to every week. -

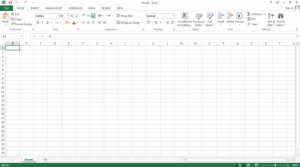

Hedge Funds / Private Equity, Securities and Exchange Commission, Wall Street

Hedge Funds / Private Equity, Securities and Exchange Commission, Wall Street‘A Spreadsheet Did The Calculations’ Not Convincing Enough To Keep SEC From Probing Your Hedge Fund

An update from the fund that never loses money. -

Benchslaps, Federal Judges, Legal Ethics

Benchslaps, Federal Judges, Legal Ethics94-Year-Old Federal Judge's Snarky Remarks: 'Regrettable,' But Not Recusal-Worthy

A misguided recusal motion leaves a bitter taste in Judge Robert Sweet's mouth. -

Television, Wall Street

Television, Wall StreetStandard Of Review: Tracing Billions's Second Season Improvement

Billions has become one of the most consistently entertaining shows on television in its second season.  Sponsored

SponsoredEarly Adopters Of Legal AI Gaining Competitive Edge In Marketplace

How to best leverage generative AI as an early adopter with ethical use.-

Banking Law

Banking LawIt's OK To Be 'Unlovable' As Long As You Don’t Get A Margin Call

As humans we all need love, without exception, and anyone claiming otherwise is deluding themselves. -

Benchslaps, Wall Street

Benchslaps, Wall StreetEgregious Fact Pattern Earns Bank Of America A Scathing, $45+ Million Benchslap

Just how much villainy can one bank get into? -

Litigation Finance, Litigators, Money

Litigation Finance, Litigators, MoneyLitigation Finance For Defendants

Litigation finance: it's not just for plaintiffs, as finance columnist Michael McDonald explains. -

Hedge Funds / Private Equity, Politics, Wall Street

Hedge Funds / Private Equity, Politics, Wall StreetA Homecoming For Preet Bharara

Like all reunions, it’s gonna be awkward. -

FTC, Hedge Funds / Private Equity, Wall Street

FTC, Hedge Funds / Private Equity, Wall StreetFTC Now Helping Herbalife Recover From $200M FTC Fine

The Passion of Bill Ackman continues.

Sponsored

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The rise of remote work has dramatically reshaped the relationship between Lawyers and Law Firms, see how Scale LLP has taken the steps to get…

Sponsored

Legal AI: 3 Steps Law Firms Should Take Now

If 2023 introduced legal professionals to generative AI, then 2024 will be when law firms start adapting to utilize it. Things are moving fast, so…

Sponsored

The Business Case For AI At Your Law Firm

The Business Case For AI At Your Law Firm

ChatGPT ushers in the age of generative AI – even for law firms.

Sponsored

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

In this CLE-eligible webinar, we’ll explore the most common accounting pitfalls and how to avoid them for your firm.

Sponsored

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

How to best leverage generative AI as an early adopter with ethical use.

-

Litigation Finance, Litigators, Money

Litigation Finance, Litigators, MoneyThe 'Other' Litigation Finance

Personal-injury funding firms are major players in the litigation finance arena as a whole. -

Banking Law, Wall Street

Banking Law, Wall StreetHostile Work Environments Are Best For Rate-Rigging

UBS sure has a knack for nicknames. -

Television, Wall Street

Television, Wall StreetStandard Of Review: 'Billions' Returns For Its Enjoyable And Surprisingly Newsworthy Second Season

The big winners from the firing of Preet Bharara: the producers of the Showtime drama Billions. -

Biglaw, White-Collar Crime

Biglaw, White-Collar CrimeBiglaw Partner Convicted Of Insider Trading After Jury Trial

Per the prosecution, the partner got drunk on wine before spilling the beans. -

Hedge Funds / Private Equity, Money, Wall Street

Hedge Funds / Private Equity, Money, Wall StreetMarketing To Alternatives Investors

For securities lawyers and litigation financiers, the issue of how to successfully market to investors is crucial. -

Money, Wall Street

Money, Wall StreetMarissa Mayer's 'Bonus' For Running Yahoo Into The Ground: Way Bigger Than Yours

She's actually not getting her 2016 cash bonus, but this "golden parachute" is way bigger. -

Litigation Finance, Litigators, Money

Litigation Finance, Litigators, MoneyWhat Do Litigation Finance Investors Want?

The litigation finance industry is potentially compelling, but the product being presented to investors needs work.