As the old saying goes, “Change is the only constant.” And what’s true in life is true in securities law.

As the old saying goes, “Change is the only constant.” And what’s true in life is true in securities law.

It’s especially true now that we have a new presidential administration and a new chair of the Securities and Exchange Commission, former Sullivan & Cromwell partner Jay Clayton. Although Clayton has been in office for less than a year, he is already making his influence felt in the world of securities law.

How can securities lawyers keep track of the dizzying array of changes to laws and regulations? Luckily, there’s an app — or, to be more precise, a workflow solution — for that. It’s called RegReview, a new and critical component of Wolters Kluwer’s Transactional Law Suite for Securities.

Susan Chazin

Earlier this week, I discussed RegReview with Susan Chazin, Portfolio Director for Securities and Banking at Wolters Kluwer. Chazin is a lawyer by training, like many of her colleagues at Wolters Kluwer, but she has been working in the legal-information market for decades. She has been at Wolters Kluwer for more than 20 years and has worked in the securities vertical for more than a dozen years, which is where she and her colleagues developed RegReview.

“Securities is a very complex area, and the laws and regulations are constantly evolving,” Chazin said. As an example, she cited the ongoing Dodd-Frank rulemaking, which is nearing completion but not yet done.

This is where RegReview comes in. It allows lawyers to check and comply with the latest securities laws and regulations as they go about their work, whether it be preparing an SEC filing, working on securities litigation, or handling similar projects in the securities-law realm. In other words, lawyers don’t have to shuttle back and forth between the document they’re working on and the relevant rules and regulations; in RegReview, everything is integrated.

“RegReview brings the rule-checking process into the attorney’s actual workflow,” Chazin explained, “which ultimately goes to both the accuracy and efficiency of the lawyer’s work.”

Wolters Kluwer interviewed and consulted extensively with clients in the process of developing RegReview. The company’s developers wanted to know: what are the most difficult parts of a securities lawyer’s work, and how can those processes be streamlined and improved?

They identified two major pain points, according to Chazin: difficulty in identifying the latest changes to laws, regulations, and forms, and related to that, the time-consuming and error-prone process known as rule checking, which involves systemic review of all relevant laws and rules related to the filing or other document being prepared.

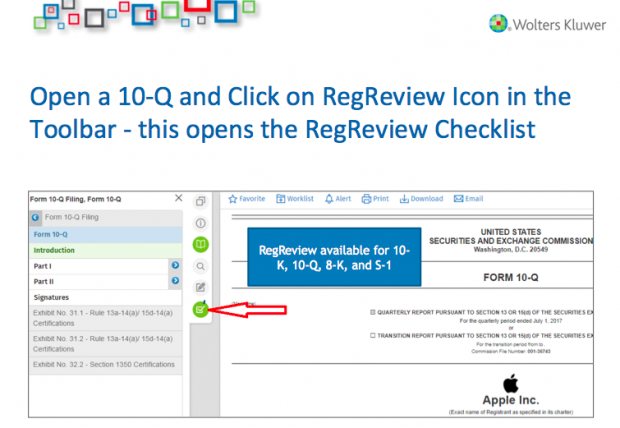

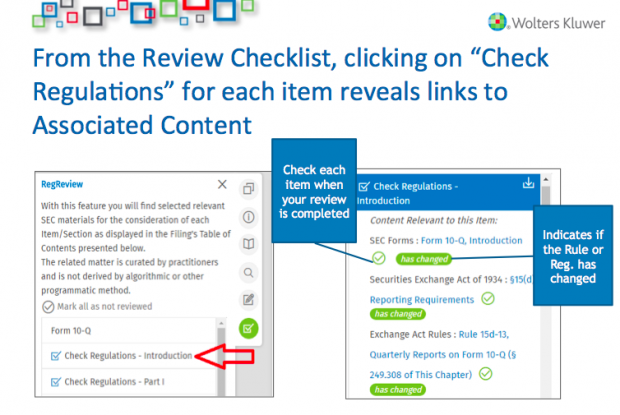

For example, say you’re working on a 10-Q, and you want to make sure that you don’t miss a thing as you prepare this critical filing for your client. RegReview provides a comprehensive checklist that you can go through, item by item, as you move through each section of the document:

By allowing the user to view the primary source materials associated with a particular form or SEC filing while the user is simultaneously viewing and editing the form or filing itself, RegReview drastically improves the speed and accuracy of the rule-checking process.

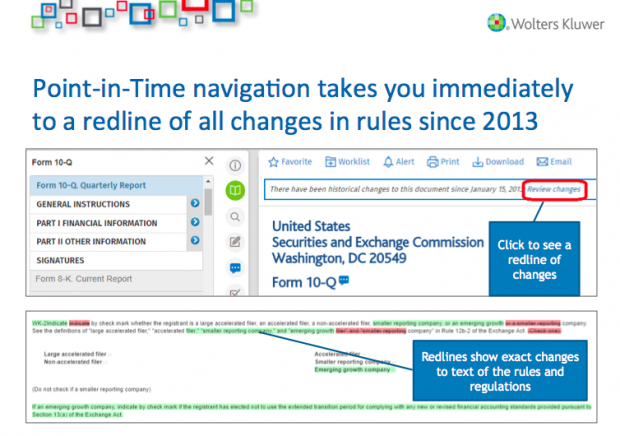

Securities filings are often prepared by taking a precedent, the most recent filing of a given type (e.g., a 10-Q), and updating it. But what if there has been an intervening change in a law or rule? The fear of missing such an update fills securities lawyers with dread.

Counsel, fret not. The “Point-in-Time” feature of RegReview has got you covered:

Point-in-Time navigation identifies the exact language within a law that has changed, allowing users to compare all prior changes made to that law since 2013. (Why 2013? Wolters Kluwer picked this date in response to its customers, who cited the five-year statute of limitations applicable to most securities actions.)

The substantive content that populates RegReview comes from Wolters Kluwer’s team of subject-matter experts in securities law. They are deeply steeped in the world of securities regulation, and their entire job is to stay abreast of every development in the field, large and small, and revise WK products accordingly.

Not surprisingly, user response to RegReview has been enthusiastic.

“Our customers are saving an enormous amount of time,” Chazin said. “They’re telling us, ‘Wow, this is really an efficiency tool’ — which is critical during a time when corporate clients are pushing back on bills, demanding more and more value from their counsel.”

“Our clients also love the checklist feature,” Chazin added — also not surprising, since it was developed in specific response to feedback provided after the product was unveiled at the 2017 conference of the American Association of Law Libraries (AALL).

Indeed, responding to the needs and wishes of clients is a continuous process when it comes to RegReview. As customers raise issues and make suggestions to Wolters Kluwer, the company and its developers will develop, test, and implement future enhancements. Thanks to the talent and responsiveness of its product and development teams, Wolters Kluwer can roll out an improvement to the platform in just a few weeks.

Just as securities laws and regulations are always changing, the tools used by lawyers to monitor these developments must evolve as well. After all, change is the only constant.

Wolters Kluwer Transforms the SEC Filings Process with Introduction of RegReview [Wolters Kluwer]

Wolters Kluwer to Unveil Two Tools to Bolster Securities Law Work [LawSites]

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].