Cheapskates At Jones Day Bill Former Associate For Bar Prep

Just because you CAN bill someone doesn't mean you SHOULD.

(Photo by David Lat)

Last week, we heard about a law firm suing its former associates for not billing enough hours. Asking associates to pay for your own book of business failings marks a new low in an industry fraught with lows. The firm’s employment agreement explicitly laid this out, but putting aside the factual and legal arguments about unconscionable contracts and rewriting employment conditions mid-lockdown, the real issue was, “Why does a firm think this is an acceptable business model even if it’s legal?”

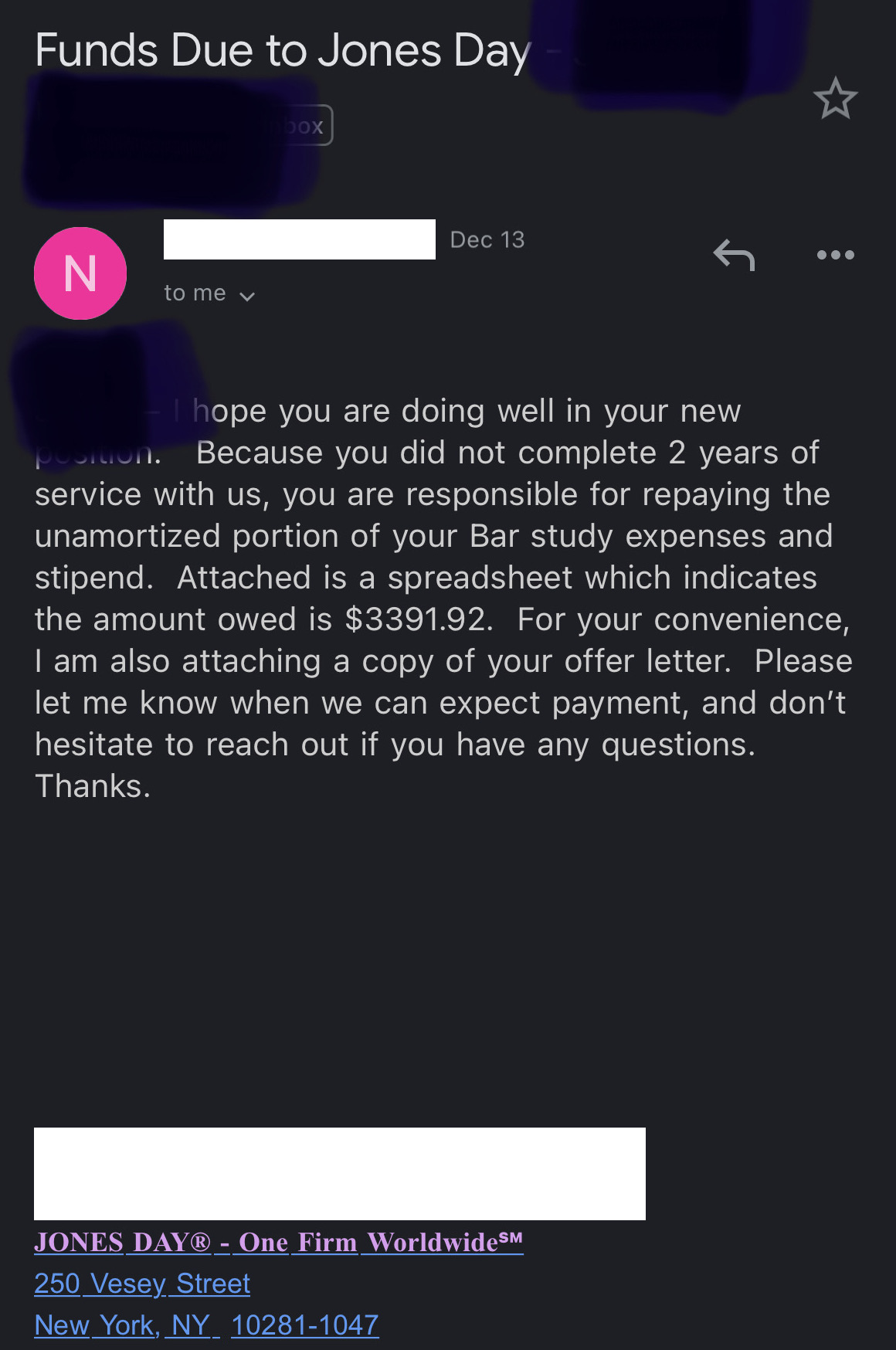

Speaking of employment agreements, Jones Day isn’t billing associates for missing on hours, but it does include in its offer letter a provision requiring associates to provide Jones Day with two years of service to cover bar study costs covered by the firm. And it’s seeking to collect from former associates. Forcing us to ask again, “Why does a firm think this is an acceptable business model even if it’s legal?”

The Business Case For AI At Your Law Firm

I guess times are tough over at Jones Day.

On the one hand, the firm laid out money for the associate expecting to get at least a couple years worth of work in return. Bar prep is costly, and the firm has made the arbitrary decision that the expense is worth about two years of associate work.

On the other, more important hand, this is stupid.

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

The Business Case For AI At Your Law Firm

Legal AI: 3 Steps Law Firms Should Take Now

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Most law firms see their network of former associates as an asset. Others… do this. Former associates are future referrals or even clients. Most attorneys lateral out because they see a better opportunity, not because they have deep hatred for their firm. Why sour that relationship? Even the disgruntled attorneys out there find their hard feelings softening with time as they focus more on positive connections with mentors and officemates who end up as partners down the road. It’s why firms spring for fancy departure dinners that end up costing… well, almost as much as the firm is asking the associate to pay them back.

Second, the fact that this is an entirely arbitrary deadline can’t be stressed enough. When does an associate “earn back” $5000 worth of bar prep? Even throwing the summer stipend in there, we’re talking about, what, $50K or so total? Average associate billing rates were $546/hour last year and Jones Day was almost certainly higher. Assume it was $600/hour (and I’m fairly sure it’s even more) and the firm collected 85 percent of 2000 hours billed… that’s over a million dollars. Subtract salary and bonus and the firm is still up around $800,000 a year. [UPDATE: I’ve been reminded that Jones Day’s black box compensation model doesn’t pay “bonuses” as opposed to pumping up the next year’s total comp by the amount of the “bonus.” Which voids this argument for Jones Day since it would only relate to a lump sum payment.]

AND IT’S QUIBBLING OVER $3400?!?

The firm might be thinking that letting one associate leave early without consequences could spiral into associates en masse taking bar prep funds and bolting. This is an absurd spillover fear. There’s just not a market for hundreds of class of 2021 associates out there.

It’s also a standard doomed to be selectively applied. My guess is the firm didn’t demand its money back when it shelled out clerkship bonuses to an associate who left after 10 months to be an ABA non-qualified federal judge. And, yeah, those bonuses probably aren’t contractually tied to an explicit work expectation like the bar prep advance is, but that misses the point. The firm treats up front payments in expectation of future work as a write-off in one case and a billable debt in another. But at the end of the day, both expenses are about the firm investing in an associate with the expectation that it will exact some amount of future billables out of them.

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

And it’s terrible publicity, though at this point Jones Day may have just given up on building a favorable public profile in favor of whining about it on the back end.

I completely understand Jones Day’s position in wanting to maximize on its investment. They thought they could squeeze another four or five hundred thousand dollars out of this $3400 expense. But discretion is the better part of valor. Cherish the hundreds of thousands you already made and just let it go. Better yet, don’t even put this provision in the offer letter.

It reads as cheap.

And for all the slings and arrows hurled Jones Day’s direction, “cheap” usually isn’t one of them.

Earlier: Law Firm Sues Associates For Not Billing Enough

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.