The Value of Middle-Market Litigation Finance

The current reality in the market leaves the vast majority of business litigation unserved.

Much of the litigation finance industry is focused on large commercial litigation (e.g., trade secrets, patent infringement, mass tort, etc.), or on small personal injury claims. The reason for this split across the industry is largely related to economic efficiency.

Much of the litigation finance industry is focused on large commercial litigation (e.g., trade secrets, patent infringement, mass tort, etc.), or on small personal injury claims. The reason for this split across the industry is largely related to economic efficiency.

Personal injury cases cost only a few thousand dollars to fund in many cases and can be largely evaluated with simple quantitative metrics in the span of a few minutes. Large commercial cases are typically evaluated by experienced professional attorneys – but the cost of that in-depth analysis is most economical when it involves very large cases.

The current reality in the market leaves the vast majority of business litigation unserved. That segment – the middle market, if you will – has a greater need for litigation finance, yet no one to fund such matters. In fact, there are only a handful of firms serving the middle-market cases where damages range from $500,000 to a few million dollars.

The Business Case For AI At Your Law Firm

There are some firms serving this segment of the market, but not many. The one I am most familiar with is TownCenter Partners, but occasionally larger funders will operate in the space as well. As a result, middle-market firms that I have worked with often turn to one-off funders who dabble in the the litigation finance space.

The arguments advanced by many funders against operating in the middle market typically come in one of two flavors: (1) it’s too hard to find cases in the middle market, and (2) it’s not economical to fund cases in the middle market.

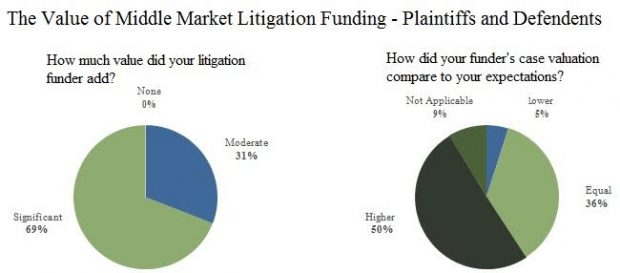

Both of these arguments are unfounded. Working with the Litigation Finance Journal, I recently did a survey of 100 plaintiffs and defendants to examine the value provided by litigation funding in the area of the middle market. One highlight from the survey results appears below:

Sponsored

AI’s Impact On Law Firms Of Every Size

The Business Case For AI At Your Law Firm

Law Firms Now Have A Choice In Their Document Comparison Software

Generative AI In Legal Work — What’s Fact And What’s Fiction?

The results reveal that the vast majority of the surveyed parties felt that litigation funders added significant value to their case, and roughly half of funded parties were pleasantly surprised at the valuation placed on their case by funders.

The point here is that litigation funders can add value to the middle market, and highlighting results like the ones above through various marketing channels can help bring in a broad swath of potential cases, thus addressing the first complaint of funders above.

The second point that funders make regarding the economics of the middle market requires deeper changes at the firm level to address. Yet it clearly can be addressed. In fact, the primary challenge with the middle market is not the size of the damages, but the ratio of damages to cost to prosecute the case. A case with $100K in costs and $200K in damages will never be worth funding, but a case with $100K in costs and $700K in damages should be worth funding.

The costs for a funder in a case are both internal and external. Internally, funders have a fixed set of costs to evaluate a case. These costs can be reduced through technology and greater case-level efficiency. Software from firms like Mighty helps with this issue, for instance. The external costs of the lawyers involved in the case are more difficult to control, but funders can control those costs if they work at it, in the same way that any company has to deal with cost pressures in a supply chain.

On the whole, the middle market in litigation finance may seem challenging for funders, but the reality is that if a bank can evaluate and underwrite a business loan or home loan with a net interest margin of 3-5%, then litigation funders should surely be able to do the same thing when dealing with an analogous margin of 6-10% or more. Higher implicit interest rates may be needed in the middle market than in larger claims, but this is a market that can be lucrative, and survey results suggest there is definitely a demand and a need for the financing.

Sponsored

How Transactional Lawyers Can Better Serve (And Maintain) Their Clients

Generative AI In Legal Work — What’s Fact And What’s Fiction?

Michael McDonald is an assistant professor of finance at Fairfield University in Connecticut. He holds a PhD in finance. Michael consults extensively through Morning Investments Consulting and writes for Litigation Finance Journal. Michael has served as an expert witness in legal disputes, and is an arbitrator with the Financial Industry National Regulatory Authority (FINRA). Michael can be reached at M.McDonald@MorningInvestmentsCT.com.