Morning Docket: 02.20.26

* Files reveal Kathy Ruemmler conferred with Jeffrey Epstein on Secret Service prostitution scandal. On the one hand, it’s important to confer with experts. On the other… [Yahoo Finance]

* “A furious daughter has sent an email to hundreds of law firms alleging that a legal recruiter had an affair with her father. The outraged daughter sent the email with the subject heading of “WHORE”…” [Roll on Friday]

* DHS issues new order asserting more authority to potentially detain legal refugees. [PBS]

* JPMorgan Chase argues Donald Trump fraudulently added them to his $5B debanking LOLsuit. [CNN]

* Practicing for 17 years after losing license earns $30,000 sanction. [ABA Journal]

* Trump nominating his lawyer from E. Jean Carroll losses to the Eighth Circuit. [National Law Journal]

* DOJ claims former Google engineers took trade secrets to Iran. So, soon, the Iranians will have their search results buried under 30 sponsored links too. [Law360]

Law Professor Arrested On Over 50 Counts In CSAM Case — See Also

The Barry University School of Law Professor Is Alleged To Have Thousands Of Images: The Dow won’t protect him.

Second Time The Error: Gordon Rees gets caught in another AI hallucination mishap!

Want To Brush Up On International Law?: These schools should be at the top of your list!

Trial Attorney Pens Legal Thriller: The story is set in Florida during the Reefer Madness era.

Want Some Advice On Being A Lawyer?: Here’s a list of 100 things!

That’s A Lot Of Giving Back!: 3Ls did millions of hours of pro bono work in 2025!

Prince Andrew Makes Modern History In Epstein Case

Not being sent to the Tower at least.

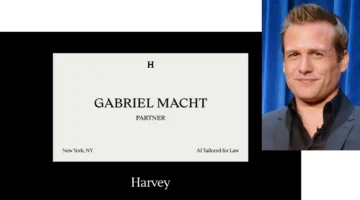

Harvey Partners With … Well, Harvey, Its Namesake, As Brand Spokesperson

The Harvey in question — the non-AI one, that is — is Gabriel Macht, the actor who played the role of lawyer Harvey Specter in the television series Suits.