Associate Bonus Watch: Good News (And Bad) From A Texas Powerhouse

Hopefully these robust bonuses will help associates deal with their high health-care costs.

In the latest Vault 100 rankings, the honors for top Texas firm went to Vinson & Elkins. This came as no surprise to observers of the Lone Star legal market, given V&E’s historically strong reputation and last year’s generous bonuses (to both lawyers and staff).

In the latest Vault 100 rankings, the honors for top Texas firm went to Vinson & Elkins. This came as no surprise to observers of the Lone Star legal market, given V&E’s historically strong reputation and last year’s generous bonuses (to both lawyers and staff).

How about the firm’s 2017 bonuses, announced last week? Once again, people are pleased:

V&E’s bonus structure stayed the same as last year – Cravath match at 2,000 hours (likely lower hours requirements for the NYC and DC offices), with supplemental bonuses of 1.10x – 1.35x for high billers (2,150+). All first years (class of 2016) again received the standard $15,000 bonus regardless of hitting hours.

Everyone seems very happy with this bonus structure. It gives associates the opportunity to earn just as much — and likely more — than associates at many of the other firms that have entered the Texas market in recent years. 2017 was another record year for V&E, so it’s nice of the firm to share the wealth.

In addition, V&E also gave a special bonus to all administrative and paralegal staff.

Attention Buyer: Not All Legal AI Models Are Created Equal

Said a second source:

[B]onuses were generally very well received. Standard bonuses for 2000+ billers were at market, and it appears that there were undisclosed bumps at 2150, 2300 and 2500+ of 10%, 25% and 35%, respectively. Class of 2016 all got at least the minimum bonus.

And a third:

I was pleased with my bonus. I received a substantial supplemental bonus on top of my class bonus for close to 2400 hours. They also did bonuses to all staff.

Sponsored

How To Maximize Productivity With Westlaw Precision With CoCounsel

Biglaw Professionals: We Want To Know About Your Dream Job

Calling All Biglaw Pros! Your Dream Job Awaits—Take Our Survey

Calling All Biglaw Pros! Your Dream Job Awaits—Take Our Survey

For the full memo, which includes a gracious shout-out to the V&E staff who worked so hard to keep the firm running smoothly during Hurricane Harvey, turn to the next page.

And now, a bit of bad news out of Vinson & Elkins. Back in November, after we covered some unpopular changes to Simpson Thacher’s health insurance for associates, we received similar complaints about V&E. For example:

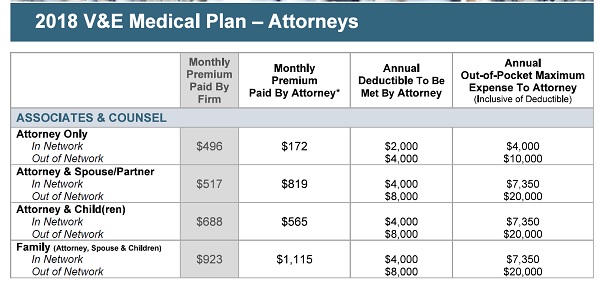

When I read your article about Simpson Thacher’s health insurance increases, I couldn’t help but laugh. Obviously, I feel for those attorneys, but they have no idea how lucky they are. I’ve attached below a screenshot of V&E’s “health insurance” plan (a term I use very loosely, as there really isn’t much here by way of insurance). While the single attorney numbers are comparable to ST’s, note the discrepancy when you move to the couple and family scenarios.

Specifically, I am an attorney with a family, so I will be paying $1,115 a month in premiums for health insurance. You read that right. To compare, a similarly situated ST attorney would be paying less than half ($499.06). And of course, that doesn’t mean my deductible is any lower – in fact, my deductible is higher, at $4,000, with a max out of pocket of $7,350 (compared to ST’s $3,500 and $7,000). Also keep in mind that these are “high deductible” plans, so there is almost no coverage to speak of until you hit your deductible (in other words, no copays for doctor’s visits or prescriptions – you pay the full amount). For a firm that claims to be “family friendly,” they sure know how to stick it to associates with dependents.

So in sum, I pay $13,380 a year in premiums for the privilege of paying $4,000 for health care before any kind of “insurance” kicks in. Simpson Thacher associates can cry me a river.

Note that the below numbers represent (1) a “streamlining of V&E’s health plan, which eliminated the lower deductible option that was available in 2017,” and (2) increased premiums all around.

Here’s the chart of premiums for 2018:

Sponsored

Raising The Bar in Bar Prep

Attention Buyer: Not All Legal AI Models Are Created Equal

Yikes. And this is admittedly speculative on my part, but I’m guessing that more Texas-based Vinson associates have families compared to NYC-based Simpson associates. So the painful premiums for family coverage probably affect a higher percentage of V&E associates compared to their counterparts at STB.

UPDATE (11:25 p.m.): A correction from an observant reader: “The V&E associate complained that he pays more than double the Simpson Thatcher health insurance. In the Simpson Thatcher article, the numbers quoted were for semimonthly contributions, so really, the numbers would be pretty close.”

Will Vinson & Elkins make any changes to its health insurance plans to lighten the burden on associates? To its credit, the firm has been responsive to associate concerns and complaints in the past. For example, the past few years of well-received bonuses were preceded by years when responses were more mixed. And if you go back even further in time, after carping about the complexity of its bonus scheme, which at the time involved a deferred-compensation component, V&E simplified its system.

So it’s quite possible that Vinson & Elkins will make adjustments to its medical plan; time will tell. In the meantime, congratulations once again to V&E associates on the robust bonuses, which go a long way toward ameliorating those high health-care costs.

(Flip to the next page to read the V&E bonus memo, sent out by chairman Mark Kelly and managing partner Scott Wulfe.)

Earlier: Associate Bonus Watch (2016): To Play In The Big Leagues, Pay Like The Big Leagues

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].