(Photo by Frazer Harrison/Getty Images)

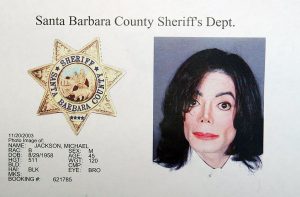

Michael Jackson, the King of Pop, was for a time the most famous man in the world. Most of us remember him for his multiple hit songs during the ’80s and ’90s. Like some celebrities who have lives normal people can only dream of, he was not a chill, normal dude. He was known to be reclusive and had all sorts of eccentricities. Later in life, he again attracted media attention when he was the defendant in a civil lawsuit and a criminal trial where he was accused of child molestation. And finally, the world was shocked to learn about his untimely death under suspicious circumstances.

To prepare Jackson’s estate tax return, his estate hired multiple reputable consulting firms to value the tangible and intangible assets. These assets included his house, his businesses, the value of his likeness and image, and two remote bankruptcy trusts. One of these trusts, called New Horizon Trust II contained the copyrights to multiple Beatles songs. The other trust, called New Horizon Trust III contained the copyrights to a number of artists, but mostly to Jackson himself. Further complicating this matter was that Jackson co-wrote many of the songs with others.

The Next Chapter In Legal Tech Innovation: Introducing Protégé™

Meet LexisNexis Protégé™, the new AI assistant that leverages personalization choices controlled by the user or their organization to optimize the individual’s AI experience.

For those who didn’t know (like myself), a remote bankruptcy trust allows lenders to isolate collateral from future claims from other creditors in case the debtor files bankruptcy.

The IRS selected the return for audit and was very skeptical about the valuation of some of the estate assets. For example, the estate’s return claimed the value of Jackson’s image and likeness at $2,105. No, this is not a shorthand for $2.1 billion. It is two thousand one hundred and five dollars. That is one month’s rent for a dilapidated studio apartment in Los Angeles or New York City.

In May 2013, the IRS then sent a notice of deficiency to the estate proposing that Jackson’s estate pay just over $500 million in estate taxes. They did this by submitting their own proposed valuations of the estate assets. The IRS found that Jackson’s likeness and image was worth over $434 million. The estate disagreed and petitioned the U.S. Tax Court.

The Jackson estate was represented by lawyers from Hochman, Salkin, Toscher and Perez. One of the firm’s former lawyers was Charles Rettig, the current IRS commissioner. For the purpose of full disclosure, I worked at the firm for a few months although I did not participate in that case.

The Hidden Threat: How Fake Identities used by Remote Employees Put Your Business at Risk—and How to Defend Against This

Based on our experience in recent client matters, we have seen an escalating threat posed by the Democratic People’s Republic of Korea (DPRK) information technology (IT) workers engaging in sophisticated schemes to evade US and UN sanctions, steal intellectual property from US companies, and/or inject ransomware into company IT environments, in support of enhancing North Korea’s illicit weapons program.

As this was a large case, both parties spent several years attempting to settle the case before trial. In the end, there were three issues that were unresolved. First was the value of Jackson’s likeness and image. The second and third were the value of the New Horizon Trusts II and III.

Last week, Judge Holmes of the U.S. Tax Court issued a 271-page opinion with his findings. It begins with a detailed history of Michael Jackson’s life, his successes, his hardships. It noted that after the accusations of child abuse, his finances took a sharp turn for the worse. His sponsors left him. Few people wanted to do business with him despite his past successes. He even had some questionable advisers which probably made the situation worse. But he continued to live a lavish lifestyle financed by taking loans secured by his assets. Bankruptcy was becoming an option.

To solve his financial woes, Jackson cleaned house and, with new advisors, a plan was set for Jackson’s possible comeback. But he died before it came to fruition.

The opinion eerily stated that “[s]oon the hospital where Jackson’s body lay surrounded by much of his family had another room filled with a haphazard team of intellectual-property lawyers and advisers -– so many that they might have outnumbered Jackson’s family. Once there, they immediately began to discuss the administration of the Estate and how to protect his image and likeness.”

The court then discussed the valuation of the three assets.

I’ll start with the New Horizon Trust II containing the copyrights to the Beatles songs. The estate valued the asset at zero while the IRS valued at $469 million. Looking at calculations, assumptions and forecasts from both parties’ experts, the court found that Jackson’s interest the trust assets was valued at over $227 million. But he has encumbered his interest with over $315 million in loans. Which means that if it were to be liquidated to pay creditors, the trust would be worthless. Thus the court valued the trust asset to zero.

The second issue is Jackson’s image and likeness. The court found it hard to believe that the value of the King of Pop would be comparable to a 20-year-old highly used Honda Civic. Despite Jackson’s past troubles, the court found that his likeness and image could generate revenue after death possibly due to post-death public interest (good examples include Tupac Shakur and Bruce Lee). However, the revenue will be nowhere near what would be made while he was living. The court found the value of Jackson’s image and likeness at over $4 million.

One thing worth noting on this issue was that the IRS’s expert tried to pump up the value of Jackson’s likeness by including the potential revenue from possible future ventures such as a film, amusement parks, and merchandising. However, the court rejected the idea of including unforeseeable events in the valuation.

The final issue was the value of New Horizon Trust III. The court noted that the major asset in the trust — the Mijac music catalog containing copyrights to various songs by Jackson and others — would be the most complicated to value. This is because the income comes from five groups of songs and each group produces income from three different sources. Jackson’s estate valued this at over $2 million while the IRS valued it initially at over $58 million. But relying mainly on the calculations and testimony of the IRS’s expert, and considering the possible post-death interest in Jackson’s music, the court concluded that the value of the Mijac catalogue was at $107 million.

This resulted in a tax increase but nowhere near what the IRS was hoping for. The court forgave the accuracy-related penalties because it found that the estate reasonably relied on their consultants when determining the value of Jackson’s assets that were reported on the estate tax return.

A complex valuation case is rarely black and white so it relies on expert testimony. It is imperative that the experts are knowledgeable and credible. The court’s opinion made it a point to note the questionable credibility of the IRS’s lone expert. He testified that he never worked for the IRS but the court later learned that the expert was hired by the IRS a few years prior for another case. Because of that, the court noted that the value of his testimony could be diminished.

A wealthy estate like Jackson’s also had one other procedural option. File a lawsuit for refund in federal court. However, this requires full payment of the $500 million proposed by the IRS. In federal court, Jackson’s case could be heard before a jury which can change litigation strategy. A jury acquitted Jackson of all criminal charges related to child molestation in 2005. But while a jury might not want to see Jackson in jail, they might feel differently about paying back taxes. Jurors will likely have a harder time believing that Jackson’s likeness is worth $2,000.

The heart of this case was about the value of Jackson’s assets. But the rule is that the value of the gross estate of a decedent is the value of the assets at the time of his death. Michael Jackson died in 2009. At that time, how relevant was he in the music industry? He was planning a comeback tour and other events to rehabilitate his image and to pay creditors. At that time, no one knows whether it will succeed. And now we will never know. As I was writing this, I was listening to a lot of his songs from the ’80s and ’90s, and it brought back memories of good times. The value of that is priceless.

Steven Chung is a tax attorney in Los Angeles, California. He helps people with basic tax planning and resolve tax disputes. He is also sympathetic to people with large student loans. He can be reached via email at [email protected]. Or you can connect with him on Twitter (@stevenchung) and connect with him on LinkedIn.