Egregious Fact Pattern Earns Bank Of America A Scathing, $45+ Million Benchslap

Just how much villainy can one bank get into?

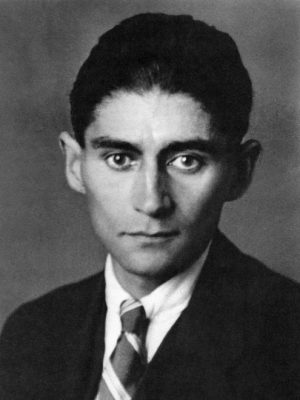

According to the lengthy recitation of facts in this opinion from Bankruptcy Judge Christopher Klein, the abuse heaped upon these homeowners by Bank of America was so vile and despicable that he could frame the decision only by drawing upon the macabre existential horrors of Franz Kafka.

According to the lengthy recitation of facts in this opinion from Bankruptcy Judge Christopher Klein, the abuse heaped upon these homeowners by Bank of America was so vile and despicable that he could frame the decision only by drawing upon the macabre existential horrors of Franz Kafka.

Franz Kafka lives. This automatic stay violation case reveals that he works at Bank of America.

Judge Klein undoubtedly intended to reference the alienating, bureaucratic horrors faced by the protagonist of The Trial, but that’s a tenuous reference given that, in the form of Judge Klein, the law actually helped the plaintiffs here.

Curbing Client And Talent Loss With Productivity Tech

Frankly, another of Kafka’s works seems more appropriate:

When Bank of America woke up one morning from unsettling dreams, it found itself changed in its bed into a monstrous vermin.

If you don’t know who Franz Kafka is, then you probably shouldn’t have made it to law school, but you can catch up with this animated rock opera:

Sponsored

Generative AI at Work: Boosting e-Discovery Efficiency for Corporate Legal Teams

Law Firm Business Development Is More Than Relationship Building

AI Presents Both Opportunities And Risks For Lawyers. Are You Prepared?

Happy Lawyers, Better Results The Key To Thriving In Tough Times

The tale of Bank of America’s dealings with Erik and Renée Sundquist shock even a world numbed to robosigning and false affidavits. To quote the opinion:

The mirage of a promised mortgage modification lured the plaintiff debtors into a kafkaesque nightmare of stay-violating foreclosure and unlawful detainer, tardy foreclosure rescission kept secret for months, home looted while debtors were dispossessed, emotional distress, lost income, apparent heart attack, suicide attempt, and post-traumatic stress disorder, for all of which Bank of America disclaims responsibility.

The statement of facts lives up to this bold introduction. A couple was “stampeded” into a mortgage they didn’t want by the threat of an all-cash buyer and the promise that they could modify their mortgage immediately. This, as you might expect since you’ve seen The Big Short, was not true. But sticking people with a bad loan is one thing. Forcing them into default “for their own good” is another:

Their sole reason for defaulting, which they did with considerable reluctance (their credit score had been above 800), was acquiescence in Bank of America’s demand that they default as a precondition for loan modification discussions with Bank of America.

Oh, this is like a bad horror film: “Don’t go in the closet (read: default)!” Terrifyingly, a Bank of America employee with a bad case of honest-itis would eventually tell Renée Sundquist that the loan modification ploy was “just a way to create funds for the banks before foreclosure.”

Sponsored

Curbing Client And Talent Loss With Productivity Tech

Happy Lawyers, Better Results The Key To Thriving In Tough Times

Much like the gatekeeper in Before the Law, the Sundquists were set to die before getting access to this modification. See how all these Kafka references just keep coming!

Bank of America started a multi-year “dual-tracking” game of cat-and-mouse. With one paw, Bank of America batted the debtors between about twenty loan modification requests or supplements that routinely were either “lost” or declared insufficient, or incomplete, or stale and in need of re-submission, or denied without comprehensible explanation but without prejudice to yet another request. With the other paw, Bank of America repeatedly scheduled foreclosures.

The Sundquists went into bankruptcy to improve their financial position in the eyes of Bank of America, as if the Moloch of Charlotte could be appeased. Ultimately, BofA sold the house even though it concedes that it knew of the bankruptcy.

The automatic stay-violating foreclosure was thereafter apparent to anyone at Bank of America who cared to look. Nobody at Bank of America cared to look.

The bank went forward with an eviction effort when their internal notes acknowledged they knew the foreclosure sale was invalid. So the Sundquists moved out at personal expense.

Now here’s where this gets, amazingly, even worse. The Sundquists drop their Chapter 13 case because they figure there’s no longer any point and they just let Bank of America take the house. Meanwhile, Bank of America decides to — without telling the Sundquists or their lawyer — transfer the title back into their name. But lest you think we’d hit rock bottom of shady this far into the facts, when the Sundquists got back to their home, they discovered that Bank of America had looted the appliances and killed all the landscaping, all while knowing that they’d transferred the title back to the Sundquists. BofA steadfastly refused to compensate the Sundquists for personal property taken from the residence they owned.

The Sundquists then got hit with a $20K HOA bill because HOAs exist to make your worst day a little worse.

Oh, and then the CEO’s office lied to the CFPB about the matter, which Judge Klein describes as the point where BofA “strayed across the civil-criminal frontier.”

With a record this troubling — with wrongdoing running literally all the way to the top — Judge Klein determined that compensatory damages couldn’t deter an entity like Bank of America and slapped them with a $45 million punitive damages judgment, with $40 million earmarked for California law schools and consumer-rights organizations. And to guarantee that the bank doesn’t try to bleed the Sundquists dry on appeal, he granted the named beneficiaries standing to assist in any appeal.

Frankly, BofA is getting off light on these facts, but there’s not much more to be done. If only there were some device that could viciously tattoo an entire mortgage closing onto a bank CEO’s body over the course of 12 hours…

(The full opinion is available on the next page…)

Joe Patrice is an editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news.

Joe Patrice is an editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news.