First-Year Associates Getting Totally Hosed By Trump's Tax Plan

Your tax bill is about to go up...

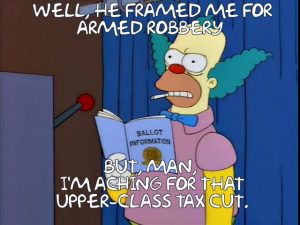

If you were one of those young lawyers who looked at Donald Trump’s campaign pledges and early proposals and recognized the pure hellscape he’s hoping to unleash on the country but decided, instead, to pull a Krusty:

Then good news! You screwed yourself.

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

Yep, lawyers are getting soaked in the current Trump tax proposal, and no one’s getting soaked worse than the first-year associates.

NPR’s John Ydstie writes up the new Trump tax proposal, and in the end it’s the upper-middle-class professionals getting it the worst.

Right now, single tax filers pay 28 percent on income from $91,150 to $190,150. Income beyond that up to $413,350 gets taxed at 33 percent.

Trump’s plan would move all income over $112,500 to the 33 percent rate. So those associates making $180K and expecting to pay in the 28 percent bracket (except, probably, for their bonuses) just saw over 60 grand of their salaries experience a 5 percent rate hike. Sorry. And those of you at firms paying below market who thought, “well at least I pay less in taxes,” you’re screwed too.

Sponsored

Legal AI: 3 Steps Law Firms Should Take Now

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Obviously this is bad news for all lawyers because making the marginal income rate break at $112,500 is brutal for higher incomes. That said, if you make more than $413,350, you’re on easy street: Trump’s fully eliminating the brackets above 33 percent. So now someone earning $112,500 a year is now in the same bracket as someone pulling down a multimillion-dollar salary.

What a time to be alive!

In case you wanted more good news, he’s also eliminating the $4,000 exemption for each person living in a household. So try not to have any kids either.

OK, back to your drudgery folks. Midterms are only two years away.

Who Benefits From Donald Trump’s Tax Plan? [NPR]

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The Business Case For AI At Your Law Firm

Joe Patrice is an editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news.