Taxes

-

Biglaw

BiglawWill This Biglaw Firm's Bonus Tradition Wind Up Screwing Associates?

This difference could have a big impact. -

Money, Small Law Firms, Solo Practitioners, Student Loans

Money, Small Law Firms, Solo Practitioners, Student LoansThe Financial Trifecta: How To Deal With Student Loans, Retirement Savings, And A Mortgage

Everyone's priorities and circumstances are different, but here are some general pointers.  Sponsored

SponsoredIs The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The rise of remote work has dramatically reshaped the relationship between Lawyers and Law Firms, see how Scale LLP has taken the steps to get…-

-

Morning Docket, Politics

Morning Docket, PoliticsMorning Docket: 04.12.17

* The Republicans hold on to the House seat vacated by CIA director Mike Pompeo; state treasurer Ron Estes defeated James Thompson, a Wichita civil rights lawyer. [New York Times]

* So it seems the FBI did obtain a FISA warrant to monitor the communications of a Trump adviser (foreign policy adviser Carter Page). [Washington Post]

* In a time when many firms are closing offices, Adams and Reese is opening new ones, in Atlanta and Fort Lauderdale. [Law.com]

* The retirement buzz around Justice Anthony M. Kennedy persists — and stems from conversations Kennedy has had with people close to him. [Bloomberg and CNN via How Appealing]

* As for Justice Ruth Bader Ginsburg, has she been enjoying Opus One yet again? [New York Daily News]

* Yes, it’s possible for an in-house legal department to be too cost-conscious — just ask Wells Fargo. [Big Law Business]

* A professor accused of sexual harassment by a student and a staff member just lost his case before the Sixth Circuit. [Law.com]

* Speaking of things sexual… don’t write “sexual favors” in the check memo line when paying your taxes. [Billings Gazette]

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 04.10.17

* Nine months from now, look for the Gorsuch effect. [Clickhole]

* Welcome to the Supreme Court, Neil. [Huffington Post]

* Will Justice Kennedy take the retirement bait? [Slate]

* A blueprint for getting Trump’s tax plan done by August. [The Hill]

* Technology’s role in reducing drunk driving. [Law and More]

* Good news for Planned Parenthood out of Maryland. [The Slot]

-

Family Law, Health Care / Medicine, Kids

Family Law, Health Care / Medicine, KidsBeware The Ides Of March (And LGBT Parental Roadblocks)

If you are LGBT and want kids, it’s time to call your local ART attorney, as well as your tax lawyer. -

Health Care / Medicine, Justice

Health Care / Medicine, JusticeIs Ryancare's 'Lapsed Coverage' Surcharge Unconstitutional Under Roberts's Obamacare Precedent?

Is there a legal problem with the GOP's proposed Affordable Care Act replacement? -

Non-Sequiturs

Non-SequitursNon-Sequiturs: 01.24.17

* Elizabeth Warren’s idealism bends to the new political reality. [The Hill]

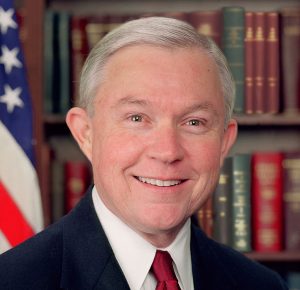

* We get a one week reprieve from Jeff Sessions as the next Attorney General.[Politico]

* Welp, this horrific perversion of religion is particularly stomach turning. [Wonkette]

* Are the Dems willing to play ball? [Slate]

* The United Kingdom’s plan to weaponize taxes. [Tax Law Prof]

* So… what’s the injury in the Emoluments Clause case? [Dorf on Law]

* Reflections on Scalia’s time on the bench. [YouTube]

https://www.youtube.com/watch?v=yu8K8DTujSA&feature=youtu.be&t=11m58s

Sponsored

SponsoredThe Business Case For AI At Your Law Firm

ChatGPT ushers in the age of generative AI – even for law firms.-

Tax Law

Tax LawMcDonald's Thirsty As Hell To Live That Post-Brexit Tax Life

Unclear if fast food giant aware that Ireland is a thing. -

Politics, Tax Law

Politics, Tax LawFirst-Year Associates Getting Totally Hosed By Trump's Tax Plan

Your tax bill is about to go up... -

Non-Sequiturs

Non-SequitursNon-Sequiturs: 10.12.16

* SCOTUS just put limits on victim impact statements. [Slate]

* The lawyers for the Paris terror attack suspect have thrown in the towel. [Huffington Post]

* Are Biglaw partners the new heroes of American capitalism? [Law and More]

* Al Gore using his experience to encourage Floridians to get out the vote. [Election Law Blog]

* A look at the competing tax plans of Trump and Clinton. [Pacific Standard Magazine]

* …And now you can be served by Twitter. [US News]

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 10.04.16

* Why has RBG been speaking up on political issues? And what does that mean for the future? [New Republic]

* Should you be using some of your new, higher salaries to invest in Manhattan property? [Law and More]

* A look at Texas Supreme Court Justice Don Willet and his Twitter account. [Texas Lawyer]

* So you say you want to start your own law practice. Now what? [Reboot Your Law Practice]

* The bizarre trial of Ammon Bundy. [Huffington Post]

* Will Donald Trump inspire a nation of tax evaders? [Slate]

-

Money, Tax Law, Technology

Money, Tax Law, TechnologyStat Of The Week: Europe Calls Shenanigans On Apple

The $14.5 billion penalty against Apple is the largest the EU has ever levied against a single corporation.

Sponsored

The Business Case For AI At Your Law Firm

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Early Adopters Of Legal AI Gaining Competitive Edge In Marketplace

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Legal AI: 3 Steps Law Firms Should Take Now

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 09.01.16

* It’s official: a judge has ruled Beyoncé’s landmark visual album, Lemonade, did not infringe on a white dude’s indie film. [Hollywood Reporter]

* Tim Cook is pissed off about his Irish tax bill. [Huffington Post]

* Will writing these things on legal documents get you fired? [Defenestration Magazine]

* The chances of lawyers landing on their feet when they’ve been fired at 61. [Law and More]

* Does the length of a jury’s deliberation have a correlation to the verdict returned? [Versus Texas]

-

Politics, Tax Law

Politics, Tax LawDonald Trump Isn't Alone In Not Releasing His Tax Returns, But It Isn't A Lot Of Company

Who else played hard to get with their tax returns? -

Non-Sequiturs

Non-SequitursNon-Sequiturs: 07.05.16

* Tips from a Biglaw partner on balancing work and motherhood. [Big Law Business]

* But not everyone thinks that Biglaw is conducive to balancing family life with work. [Law and More]

* Which attorneys were most victorious at oral argument in front of the Supreme Court this Term? [Empirical SCOTUS]

* Legal pot growers have a looming battle with the IRS. [Slate]

* Is now the time to end the death penalty? [Guile is Good]

* RIP, Judge Abner Mikva, whose career also included work as a U.S. congressman from Illinois, White House counsel to President Bill Clinton, and mentor to Barack Obama. He died this 4th of July. [Washington Post]

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 04.25.16

* Kate Middleton’s famous wedding dress by Sarah Burton for Alexander McQueen is now the subject of a lawsuit, with designer Christine Kendall claiming it is a knockoff. [Fashionista]

* This lawyer, Helene Goodin, after 22 years in the legal profession, left it all to open her own bakery. [Huffington Post]

* The rest of the world discovers Delaware’s a haven for holding companies; lawyers everywhere shrug. [Gawker]

* When humanitarian aid actually caused more economic hardship for the very people we are supposed to be “helping.” [Lawyers, Guns and Money]

* Can Indian start-ups render the Biglaw firm structure unnecessary? [Law and More]

* Richard Hsu talks with Scott Adams, the creator of the Dilbert cartoon strip. [Hsu Untied]

* The Constitutional Accountability Center is holding an event this Thursday, April 28th at the National Press Club in D.C. on the Supreme Court’s docket this Term, previewing decisions yet to be handed down and discussing key themes from the Term. [Constitutional Accountability Center]

* Speaking of SCOTUS, if you’re interested in Supreme Court lit, check out this televised panel of authors, including Irin Carmon of Notorious RBG and ATL editor David Lat of Supreme Ambitions (affiliate links). [C-SPAN]

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 04.21.16

* Still wondering why we got rid of the comments? Here’s David Lat’s in-depth look at the issue. (Spoiler alert: it’s because they were terrible.) [Washington Post]

* Is this the reason more attorneys aren’t seeking help for the addiction issues they face? [Law and More]

* Kansas may be hurting after a disastrous series of tax cuts, but that hasn’t stopped the politicians there. [Slate]

* How Bill Clinton’s crime bill shaped twenty years of activism. [Pacific Standard Magazine]

* Yes, it has become painfully clear that the New York electoral system is in need of reform. [Lawyers, Guns and Money]

* You think you know Harriet Tubman, but really, you have no idea. [Wonkblog]

* David Lat chats with Mirriam Seddiq, host of the “Not Guilty No Way” podcast, about legal blogging, perceptions of women lawyers, and his former boss, Chris Christie. [Not Guilty No Way via Soundcloud]

-

Non-Sequiturs

Non-SequitursNon-Sequiturs: 04.20.16

* Well, this warms my calloused heart: Chief Justice Roberts learned some sign language to swear 12 deaf and hard of hearing lawyers into the Supreme Court. [Washington Post]

* An enlightening interview with an attorney that proves lawyers can have entrepreneurial spirit, Richard Nacht. [Law and More]

* Professor Rick Hasen’s analysis of the Supreme Court’s decision in the Arizona redistricting case. [Election Law Blog]

* An interview with Matt Delmont, author of Why Busing Failed (affiliate link), on the continued segregation of schools. [Lawyers, Guns and Money]

* Did lawyer Linda Shi just help design a revolution in air conditioning? The product is being funded through Kickstarter, and the size of the unit makes me think it’d be welcomed in many NYC apartments this summer. [Kickstarter]

* Economists and tax law professors are getting behind Elizabeth Warren’s tax filing simplification bill. [MassLive]

* An in-depth look at black sites — CIA secret prisons, used in the U.S.’s War on Terror. [Slate]

* Our very own David Lat shares cybersecurity tips with host David Lesch on “Today’s Verdict.” [BronxNet]

-

Canada, Money, Tax Law

Canada, Money, Tax LawStop Hatin' On Lawyers For The Panama Papers

Helping you to navigate the tricky tax laws and to pay every dime of tax required—and not a cent more—is exactly what you pay your lawyer for, according to columnist Steve Dykstra.