Michael Allen

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. Michael Allen is Managing Principal at Lateral Link, focusing exclusively on partner placements with Am Law 200 clients and placements for in-house attorneys.

Though the global markets have started off inauspiciously, with several of them down significantly and China’s solvency in question, this year could hit record levels for lateral activity in Biglaw. The untold story of 2015 was that it was the best year for lateral movement since the recession. It easily beat the second highest year (2012) by over a thousand total lateral moves.

Can 2016 beat 2015’s record for lateral movement? I believe we will see three important trends emerge as 2016 unfolds.

- The Associate Market Will Remain Stable

Our past analysis has shown that the associate market is particularly vulnerable to the shocks of world markets. Why? Associate salaries are sticky; their compensation is pegged to a lockstep formula. Firms are hesitant to lower salaries; doing so would create a cascade of lateral movement away from the firm. Firms will horde associates as long as they can until they are certain that market conditions are not going to improve. Several of our recruiters were victims of this deadlock. They started working for Am Law 50 firms at the height of the recession and all the first years were corralled in empty offices for document review, other menial tasks, or often, nothing at all, as firms tried to retain their assets through the recession.

The good news for associates is a bit of an equivocation: we simply don’t know where the market is headed. Though some are expecting a bear market, domestic and foreign markets are difficult to predict. Firms are slow to respond to market trends so this uncertainty will fall in the favor of associates in the short term. At this pace, don’t expect record-beating bonuses by the end of the year, but material RIFs from dozens of firms is not expected either. That doesn’t mean that firms won’t fold or won’t seek strategic combinations, but at the current rate, the decision makers I am in contact with are optimistic about 2016.

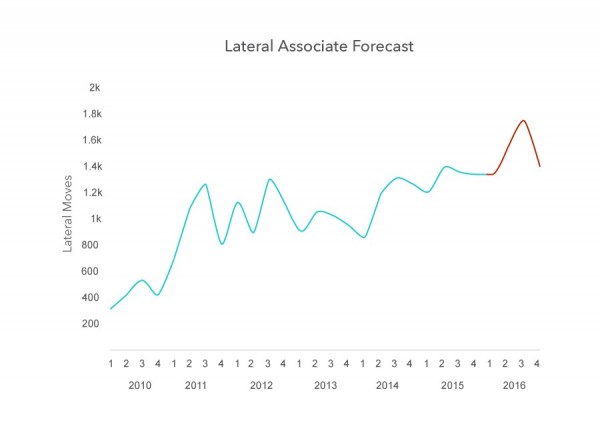

In our quarterly newsletter, we forecasted a new record of lateral movement in 2016. This model was generated using an ARIMA model (autoregressive integrated moving average), a time-series model that incorporates past trends. The model responds to past lateral trends so current market conditions are excluded. However, the model predicts that the associate market in 2016 will hit record levels.

This scenario is still a possibility. Several markets are shaping up to have a tremendous year, including Miami which is expected to grow thanks to repaired relations between the U.S. and Cuba. New York had a busy 2015 and could continue its pace through the end of 2016. Several practice areas are projected to skyrocket including data privacy and cyber crime. The progression of technology has led to the diversification of IP practice areas, particularly in San Francisco and Silicon Valley, where there is substantial demand for associates in these new practices. These new developments will offset any lag in the associate market from depressed markets.

- The Partner Lateral Market Will Actually Increase

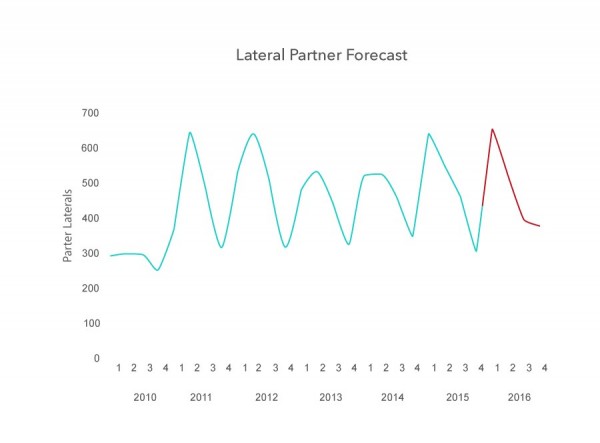

Several developments position the partner lateral market to reach record levels. However, looking at past lateral trends could forecast the most vital piece of intelligence in the partner market.

Even a cursory look will reveal why the partner market may increase. The partner market, though highly seasonal, is largely unaffected by market conditions when compared to its associate counterpart. The lowest quarter for associate movement since 2010 had 20% of the amount of movement compared to the highest quarter. By contrast, the lowest quarter for partner moves registered just under 50% of the number of moves compared to the highest quarter.

Partner movement has been roughly steady for the last four years, but it may increase due to several factors.

Mandatory retirement, a topic I have written on extensively, is due to shake the lateral market up for several reasons. Baby boomers are aging rapidly and many firms are ill equipped to handle succession planning, having held off on broaching the taboo subject until recently. Our statistics show that 9% of partners are over 65, and another 11% are between 60-65. And the Am Law 100 Firm Chairs responsible for shaping policy? 97% of them were born before 1965 according to Altman Weil.

How will this trend engender lateral movement? Partners facing mandatory retirement are anxious to move to firms with more lenient policies. However, our clients are reporting that a generational rift has formed, with the Gen Xers asking firms to enforce and shorten the mandatory retirement policies while the Baby Boomers are asking for leniency. New and existing mandatory retirement policies could create a flurry of lateral partner movement.

- Firms Will Turn To Variable Staffing To Hedge Against Risk

Associates are both costly and risky in recessions (since they are somewhat “fixed costs” or at least sticky) and we are seeing an increase in the number of firms interested in using project attorneys to augment their capabilities. These attorneys won’t completely replace associates but they will handle substantive work; from writing briefs or drafting deal documents, to joining trial or deal teams, to providing high-level substantive expertise. Lateral Link recently acquired Cadence Counsel to address variable staffing solutions for our law firm and in-house clients.

Since project attorneys are experienced, vetted, and able to seamlessly parachute in, they can easily be scaled to demand, whether the market is rising or falling. Our Cadence Counsel division helps mitigate risk since our project attorneys are paid on an hourly basis rather than an annual salary. In short, temporary upticks in work don’t always mean permanent staffing solutions.

Since the overhead is virtually non-existent, project attorneys are a risk-free proposition. I expect to see firms utilize them more often until they have more confidence in the market.

Though the market is fickle, past trends can shed light on future patterns. So far this does not appear to be another 2008/2009 meltdown. We have yet to hear about any tangible effects of the market slowdown at any Biglaw firm. We are confident that the market will hold steady, and are optimistic that 2016 could set a new record for lateral movement.

Lateral Link also realized a banner year and we are always opportunistic to hire best-in-class recruiters. Our brand, contacts, compensation, and bonus pool for recruiters far exceeds that of any other search firm (and most law firm associate bonuses for top producers). If you are a top performer, email us to join a dynamic firm that offers an unparalleled combination of resources, compensation, and quality.

![]() Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.