It’s almost impossible to open a copy of the Wall Street Journal or Bloomberg Businessweek these days without seeing evidence of how self-learning computers are upending various sectors of the economy. I have previously written about the effect that artificial intelligence is having on lawyers, including in some cases replacing lawyers wholesale. Yet, even for those lawyers focused on providing services that machines cannot replicate, the sea change in computer technology is still going to have major indirect effects.

It’s almost impossible to open a copy of the Wall Street Journal or Bloomberg Businessweek these days without seeing evidence of how self-learning computers are upending various sectors of the economy. I have previously written about the effect that artificial intelligence is having on lawyers, including in some cases replacing lawyers wholesale. Yet, even for those lawyers focused on providing services that machines cannot replicate, the sea change in computer technology is still going to have major indirect effects.

Take the hedge fund industry, for instance. For the better part of a decade, hedge funds have thrived thanks to large asset inflows and the mythos surrounding the industry. That’s changing. It’s fair to say that conventional hedge funds today are under siege and need to be thinking about where their next competitive advantage will come from. That siege is both based on fee compression due to low-cost hedge fund replication strategies, and superior performance options from self-learning machines using algorithms.

I wrote last week about how large investors can use customized hedge-fund replication strategies to get similar uncorrelated returns that hedge funds offer at a dramatically lower cost. A dozen institutional investors and family offices emailed me in less than a day to discuss the trend. Clearly, there is a lot of discontent among investors with the status quo.

Billables Are Not The Same As Cash Flow. Here’s Why That’s Important.

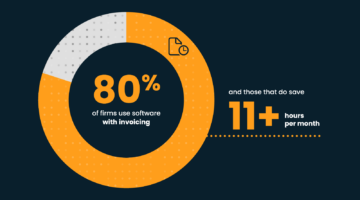

Findings from the MyCase 2025 Legal Industry Report.

On the performance side, hedge funds are being similarly challenged. Empirical evidence is beginning to suggest that self-learning machines and quant-based investing strategies are dramatically better in terms of performance than traditional human-centric investing procedures. For instance, the Bloomberg chart below shows hedge funds using AI strategies versus the broader universe. Most hedge funds are not equipped philosophically or in terms of resources to adopt this type of trading, though; Renaissance Technologies and Two Sigma are still very much the exception rather than the rule, based on my experience consulting in this area.

There are very few AI funds currently out there globally at this stage. The early adopters of machine-learning methodologies will need to build a strong track record to help bring in more investors. This requires a bulletproof strategy and a compelling marketing message. If done well though, self-learning is the key to future prosperity in the hedge fund space.

This challenge is made more difficult by the fact that investors frequently have trouble distinguishing AI funds from their more ubiquitous “quantitative” investing forerunners. Both types pf investing rely on computers to make investment decisions, but AI programs go a step further than quant software. AI software attempts to improve itself over time – essentially learning as it goes – and improving its quantitative trading strategies as it goes.

Steno’s AI Tool Steps Ahead Of The Pack

Transcript Genius is a ‘very well-behaved’ partner.

All of this is extremely important for attorneys. Hedge funds represent lucrative clients in the securities law space, and they represent attractive targets for various types of litigation. More broadly, the finance industry as a whole is an important source of business for the legal profession. Even if one believes that lawyers themselves are insulated from the changing nature of financial markets, their clients are not. Lawyers should be helping clients to adopt to this new reality by crafting legally defensible investing documents that demonstrate the value that financial firms like hedge funds add for clients. This will become more necessary if the industry begins to increasingly shift towards self-learning, machine-driven trading.

Michael McDonald is an assistant professor of finance at Fairfield University in Connecticut. He holds a PhD in finance. Michael consults extensively with organizations ranging from Fortune 500 companies to start-up businesses on financial matters through Morning Investments Consulting. Michael has served as an expert witness in legal disputes, and is an arbitrator with the Financial Industry National Regulatory Authority (FINRA). Michael can be reached at [email protected].