Biglaw Growth Is Back In A Big Way

Things are starting to look good. So get ready for the fall.

After several years of tepid growth, global Biglaw has finally broken through and enjoyed the sort of solid financial performance that usually presages a horrific collapse.

After several years of tepid growth, global Biglaw has finally broken through and enjoyed the sort of solid financial performance that usually presages a horrific collapse.

That’s perhaps too cynical. But having been through one of a Biglaw boom and bust cycle before it seems things are always at their best right before the fall. It’s when mergers and acquisitions work gets a bit too frisky and the underlying economy starts to look a bit too reckless. Maybe this time we’ll buck that trend. Stranger things have happened.

After years of solid, if unexciting, 2 to 3 percent revenue growth, the American Lawyer’s Global 100 experienced 6.4 percent growth, amassing $105.7 billion.

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Of the top 100, 40 have revenue over $1 billion, further evidence that the rich keep getting richer in the legal market. By 85th place on the Global 100, firms aren’t even cracking half a billion. Roughly a quarter of the top 100’s revenue is locked up in the top 10. What’s the significance of that kind of wealth concentration? Hard to say, but it seems to me that there’s a clear dividing line between firms set

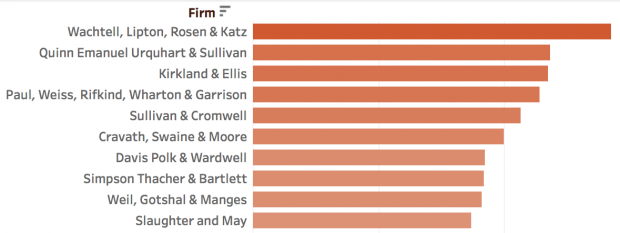

Check out American Lawyer for the full Global 100, but here’s the top 10 for bragging rights:

What about profits per equity partner? Oh, well they have those too! Here are the top 10 there.

Sponsored

Generative AI In Legal Work — What’s Fact And What’s Fiction?

Legal AI: 3 Steps Law Firms Should Take Now

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Generative AI In Legal Work — What’s Fact And What’s Fiction?

If you thought the gap between rich and poor was bad in revenue, the Global 100 firm with the lowest PPEP clocks in at $227K. They may want to check out the associate market.

There’s a lot more to read and digest over at American Lawyer.

The 2018 Global 100 [American Lawyer]

Sponsored

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

The Business Case For AI At Your Law Firm

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news.