Ron Porter

Insurance litigation can be hard to wrap your head around. Insurance is a complex financial product that can spawn complex litigation. There are so many different types of insurance, ranging from auto to homeowners’ to liability to life, and so many different possible findings that could be made in a case — a duty to defend (or no duty), a duty to indemnify (or no duty), or a breach of contract (or no breach), just to name a few.

For years, insurance companies have been collecting and drawing insights from large amounts of data, based on their many clients around the country and around the world. Insurers use these insights to make key business decisions about whether to write a certain type of insurance, how much to charge in premiums, how to resolve claims, and more.

But what about lawyers who handle insurance matters? How can they make sense of the complicated world of insurance litigation?

Luckily we live in the age of “big data” and legal analytics, which have now come to the world of insurance litigation. Last year, Lex Machina, a longtime leader in legal analytics, added insurance to the long and growing list of practice areas serviced by its award-winning platform.

And last October, in connection with the launch, Lex Machina issued its first annual Insurance Litigation Report. The report reflected data on more than 98,000 insurance cases pending in federal court since 2009 — the third-largest case set on the Lex Machina platform. (You can request your own copy of the complete report here.)

I recently spoke with Ron Porter, a Legal Data Expert in Product Liability at Lex Machina, about highlights from the report. Porter is not only a data scientist but also a lawyer, joining Lex Machina after working as a product liability lawyer for both General Motors and a Detroit law firm.

We began by discussing overall filing trends. According to the report, insurance case filings overall remained relatively steady from 2009 to 2017, down just 8.6 percent — but that figure conceals a great deal of variation by insurance line.

For example, automobile case filings increased a whopping 39 percent over this period, and cases involving uninsured or underinsured motorists doubled. What could explain these jumps? Porter suggested that they could be due to increasing medical costs associated with these claims, allowing them to meet the requirements for federal-court jurisdiction more easily. (The current minimum of $75,000 was set more than 20 years ago, back in 1996, and hasn’t budged since — even though health-care costs have skyrocketed since then.)

I asked Porter: did any findings of the report surprise him, perhaps based on his time as a product liability lawyer?

“How often insurers win,” he said. “If you look at the resolution data, insurance companies win in litigation in the 80 to 90 percent range.”

Of course, as a scrupulous data scientist, Porter pointed out to me that cases resolved on the merits, either by motion or trial, are not representative of the full universe of insurance cases. The vast majority of insurance cases settle, generally on confidential terms, so cases resolved on the merits are a relatively small slice of the overall pie.

As shown in the Lex Machina data, many of these insurer wins come through motion practice, the granting of motions to dismiss or for summary judgment. Interestingly enough, if cases go to trial, claimants prevail about 55 percent of the time.

This type of insight could be relevant to a litigator representing an insured, Porter noted. If your client’s case can make it past summary judgment, then maybe you should take your chances on going to trial (unless you get a settlement offer you can’t refuse).

Indeed, Porter identified many possible use cases of Lex Machina for insurance lawyers. If you’re a litigator representing either an insurer or an insured, for example, you can use the product to figure out the likely outcome and duration of a particular type of case in a particular type of jurisdiction (or even before a particular judge, if the case has been assigned). This type of information can be invaluable in terms of making strategic decisions such as whether to file a certain type of motion or how to staff or budget for a matter.

Lex Machina can also help litigators figure out the likely strategy of opposing counsel. You can use the platform to see what types of cases your opponent has handled and how they have fared in those cases, then click through to the docket and look at the actual pleadings filed by opposing counsel, to see the exact claims they raise and arguments they make.

If you’re in-house counsel to an insurer who needs to hire outside counsel, Lex Machina can be useful to you as well. If choosing between a few possible law firms and lawyers to hire, you can drill down and see how they have done when handling cases just like yours in a specific court or before a specific judge. You can see all the cases a lawyer or law firm has handled in the past few years — not just the handful of big wins highlighted in their pitch deck.

The Lex Machina insurance analytics can be used by claims adjusters as well as lawyers. If a claims handler is trying to decide whether to deny or pay a claim or how much to offer on a claim, what tends to happen in similar cases when they go into litigation is highly relevant information.

Not surprisingly, a number of Lex Machina’s early users in the insurance vertical are insurance companies. They include Allstate, Ambridge Partners, and Sompo International, among many others.

Other users include plaintiffs’ lawyers and litigation finance companies, according to Porter. In deciding whether to take a case on contingency or back a case as a litigation funder, the insights offered by a tool like Lex Machina can be critical.

The court data used in Lex Machina’s platform is publicly available. But trying to replicate what Lex Machina has done on your own would be an incredibly difficult and costly task, as Porter explained.

Insurance is a complicated area of law, and the underlying data is “messy.” In order to create the insurance module, Lex Machina had to collect, categorize, and “clean” a vast amount of information — data from almost 100,000 cases, filed in federal court over a decade or so. This required a huge amount of technological experience, in terms of machine learning and natural language processing, as well as human review, by a highly educated team of lawyers with specific training in insurance law.

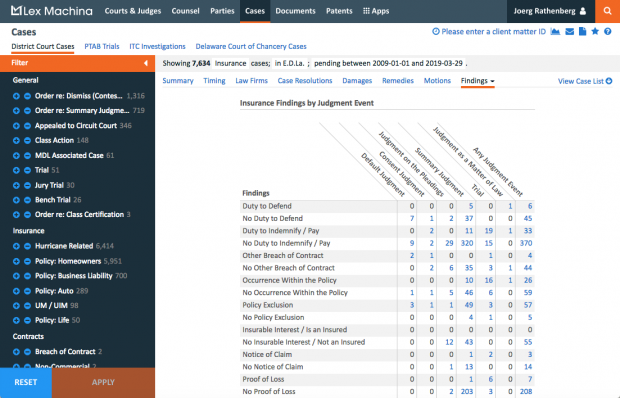

For example, take the many different types of possible findings in an insurance case. Lex Machina had to develop a detailed taxonomy of them — and then accurately apply that taxonomy to the 98,000 cases. The result is a powerful tool for litigators in the insurance space (click on the image below for a closer look):

Assembling Lex Machina’s insurance vertical involved a lot of hard work — but throughout our conversation, Ron Porter’s enthusiasm for his work was palpable.

“Putting together this platform was a challenging task, but an interesting one,” he told me. “Where else do you get to read lots and lots of very interesting opinions about insurance law?”

To be sure, insurance law might not be everyone’s cup of tea. But if it happens to be yours, you should definitely look at Lex Machina’s groundbreaking Insurance Litigation Report.

Analytics for Insurance Litigation [Lex Machina]

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].

David Lat is editor at large and founding editor of Above the Law, as well as the author of Supreme Ambitions: A Novel. He previously worked as a federal prosecutor in Newark, New Jersey; a litigation associate at Wachtell, Lipton, Rosen & Katz; and a law clerk to Judge Diarmuid F. O’Scannlain of the U.S. Court of Appeals for the Ninth Circuit. You can connect with David on Twitter (@DavidLat), LinkedIn, and Facebook, and you can reach him by email at [email protected].