(Image via Getty)

It was easy news to miss, since every recent headline containing the words “Am Law 100” seems to involve a story like Am Law 100 Firm Slashes Salaries or Am Law 100 Firm Furloughs Some, Slashes Salaries For All. So in case you did miss it: last week, the American Lawyer issued the latest Am Law 100 rankings.

The annual Am Law 100 rankings represent the nation’s 100 largest law firms, ranked by revenue. The new rankings, the 2020 Am Law 100, reflect the performance of Biglaw firms in 2019 — i.e., well before the coronavirus-driven economic downturn arrived.

Some might say: isn’t it a bit frivolous to focus on vanity metrics like profits per partner during such a time of crisis for Biglaw? But as Gina Passarella, editor-in-chief of the American Lawyer, noted on Twitter, firm finances are especially important at a time like this: they give us insight into which firms will pull through, and which ones … won’t.

So let’s dig right in. In terms of the big picture, 2019 was a very good year for the world of large law firms. Here are some metrics (noted by David Thomas in his insightful analysis of the rankings):

- Total revenue: $104 billion, up by 5 percent.

- Average revenue per lawyer: $1,001,289, up by 3 percent.

- Profits per equity partner: $1,967,895, up by 5 percent

These are impressive figures. As recently as 2014, boasting RPL of $1 million or more and PPP of $2 million or more put a firm in an elite club that Am Law dubbed the “Super Rich.” Now, those same figures make a firm … your average Am Law 100 firm.

“Everything we heard from clients at the beginning of 2020 was that 2019 was another good year, comparable to 2018,” Altman Weil consultant Eric Seeger told Am Law. “We had quite a few clients tell us that 2019 was a record financial year for them.”

But that was then, and this is now. Not surprisingly, the experts surveyed by Thomas and Am Law are not optimistic about 2020, expecting Biglaw to take a bath.

Of course, some firms will feel more pain than others:

Generally speaking, law firms that performed well in 2019 and have been performing well for the past couple of years are better positioned to weather the economic storm the COVID-19 pandemic is causing, [Wells Fargo’s Joe] Mendola says.

Zeughauser Group consultant Kent Zimmermann shares a similar sentiment. A law firm that is profitable has greater ”flexibility in how to manage through a crisis, particularly if there’s a significant drop in revenue,” he says.

With that background, let’s take a closer look at three key metrics — gross revenue, revenue per lawyer, and profits per partner — and the top 10 firms in each category.

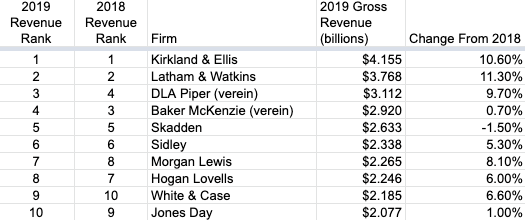

Gross Revenue

In one sense, gross revenue is the critical metric, since the Am Law 100 consists of the 100 largest firms by revenue. A firm can have super-high profits per partner — but if its total revenue isn’t big enough, it won’t make the Am Law 100.

Here are the top 10 firms by gross revenue. You can access the full list here.

Once again, Kirkland & Ellis took the top spot, becoming the first firm to break the $4 billion mark after growing its revenue by an impressive 10.6 percent. The second-place finisher, Latham & Watkins, had even stronger growth — 11.3 percent — and racked up almost $3.8 billion in revenue.

As for the rest of the top 10 firms in the 2020 rankings, they were exactly the same as the top 10 firms in the 2019 rankings, with just some (small) changes in position. No firm moved up or down by more than a single spot.

As noted by ALM, some 41 law firms grossed more than $1 billion in 2019, up from 37 firms in 2018. Again, not long ago, breaking a billion was a major achievement for a Biglaw firm. Now, it makes a firm… slightly above average in the Am Law 100.

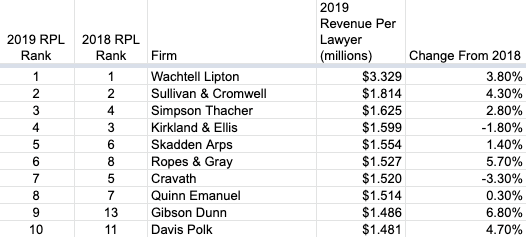

Revenue Per Lawyer

Many industry observers regard revenue per lawyer as the best indicator of a firm’s financial health. It can’t be manipulated as easily by gross revenue, which can be goosed by growing headcount (e.g., through a series of mergers), or profits per partner, which can be supercharged by shrinking the equity partnership (e.g., through de-equitization).

Here are the top 10 firms by revenue per lawyer. You can access the full list here.

Wachtell Lipton retained the top spot, with RPL of $3.3 million — some $1.5 million more than the second-place firm, Sullivan & Cromwell. Who says alternative fee arrangements can’t work? (In its flagship M&A practice, Wachtell Lipton generally bills based on the size and complexity of a transaction as opposed to by the hour.)

Most of the top firms by RPL remained the same. Congratulations to Gibson Dunn and Davis Polk on making the top ten this year, coming in at #9 and #10, respectively.

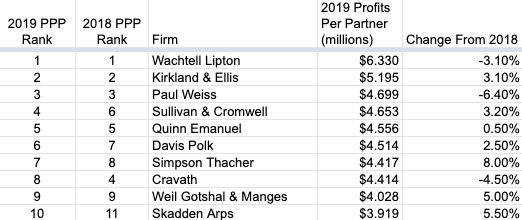

Profits Per Partner

And now, profits per partner or PPP, the ranking you’ve all been waiting for.

Here are the top 10 firms by profits per partner. You can access the full list here.

Once again, Wachtell Lipton leads the way, with a whopping $6.3 million in PPP for 2019. That represented a decrease of 3.1 percent from 2018, but it still left Wachtell more than $1 million ahead of its closest rival — Kirkland & Ellis, with $5.2 million in PPP (up by 3.1 percent from 2018).

Again, there wasn’t much movement in the top 10 firms. Skadden Arps returned to the top 10, in the #10 spot, but all of the other top 10 firms were in the top 10 last year. To make the top 10, a firm needed almost $4 million in revenue — an incredible sum.

The rest of the Am Law 100 also fared well in terms of partner profits. As noted by ALM, 24 firms had PPP of $3 million or more, up from 20 firms last year. For the Am Law 100 as a whole, average PPP increased by 5 percent in 2019.

Ah, 2019… it seems like a lifetime ago, doesn’t it? Alas, 2020 is looking very, very different.

Here at Lateral Link, we believe that the current crisis presents opportunities, for both individual lawyers and for law firms. Although the associate lateral market has cooled (unless you’re in bankruptcy — in which case, please drop me a line), the lateral partner market remains active — just as it did during the last recession.

Why? For at least two reasons. First, when firms face a shrinking pie, the way to grow revenue is by grabbing a bigger slice of that smaller pie — and the way to do that is by bringing aboard partners with big books of business.

Second, as some law firms start to encounter financial trouble, the partners at these firms with strong, portable practices will start looking around. These partners will seek more stable platforms — and might even be able to “upgrade” their platforms, since the most prestigious and profitable firms will probably weather the storm better than many others.

But a firm doesn’t need to be super-prestigious or profitable in order to benefit from the current climate. If a firm is well (and conservatively) managed — with lots of liquidity, and a war chest sufficient to ride out the crisis and lure top talent — it will also be able to get in on the lateral partner action.

If you’re a partner contemplating a lateral move or a law firm interested in lateral hiring, please feel free to reach out to me or to any of my colleagues at Lateral Link. We are ready and eager to help you navigate this rapidly evolving environment — and to take advantage of the unique opportunities that it presents.

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. David Lat is a managing director in the New York office, where he focuses on placing top associates, partners and partner groups into preeminent law firms around the country.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.