Editor’s note: Second in a three-part series. Read the first installment here.

You’ve gathered reliable company data. You’ve determined the law department’s proper lane for this transaction. You’ve maintained appropriate confidentiality and applied sound organizational principles.

Now, the ink is dry on your merger agreements — and your GC is facing down a new challenge: guiding the integration of a portfolio of companies into an existing structure.

“Every company has different internal dynamics and different ways of working, right?” says Kariem Abdellatif, the head of Mercator by Citco (Mercator), a specialist entity management provider that helps organizations manage their global entity portfolios, including during complex M&A transactions.

“So the system you set up has to be able to accommodate those differences, and the entire governance framework for managing entities needs to be flexible enough to handle not just the current complexity, but also future organizational changes.”

In this series, we’re providing a step-by-step guide for general counsel navigating a merger or other corporate transaction. In part one, we explored best practices for corporate law departments in the pre-merger phase.

Here, we’re sharing the initial to-do list for a law department once a transaction is closed.

We’ll also be discussing these topics in a webinar next month. You can pre-register here.

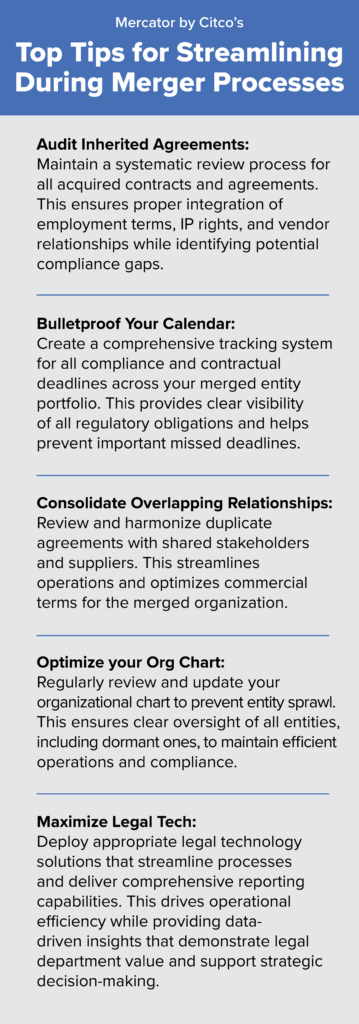

Button Up Your Contracts

Law departments would be well-advised to get a head start on shoring up their employment and intellectual property agreements as soon as a deal is inked.

This is particularly so when a large company buys a smaller entity in an equity deal, notes Scott Naturman, an M&A partner with Hughes Hubbard & Reed LLP.

That’s because smaller companies often have deficient regulatory and internal compliance programs, which can lead to contracting problems.

“Almost every deal we do, we find deficiencies, and it’s not me necessarily, but it’ll be my HR and IP colleagues looking at employment-related contracts and finding deficiencies in them,” Naturman says. “So that’s something that often has to be fixed.”

Problems can also arise related to the merged entity’s commercial contracts.

Mergers often occur between companies in similar industries, of course. As a result, the merged entity may have contracts with the same customers and suppliers as the acquirer.

If multiple contracts with the same customer or supplier have differing terms, Naturman notes, the merged business will look to maintain the best possible outcome while combining the contracts.

Some items like “most favored nation” clauses will often be vetted and mitigated in the due diligence process, but lawyers will still need to think through how to merge any overlapping agreements once the deal is closed.

Maximize the Interim Period

Even if they tend to be billed as “mergers of equals,” few mergers are actually created equal.

One key difference emerges around the closing structure — with delayed and simultaneous closings presenting their own challenges and opportunities.

When there’s a delayed closing, law departments must navigate an interim period, where you protect the value of the business while awaiting a condition to be met — regulatory approval, for example, or the greenlight from a lender.

Naturman notes that law departments can make progress on essential human resources and intellectual property tasks during this period.

“You want the in-house folks as soon as possible to be speaking with key employees and trying to lock them into agreements on their own paper, but you can’t have anything become effective until the deal closes, of course,” he says.

“If you have a delayed closing, you can reach a wider audience, while if it’s simultaneous, you don’t have that opportunity.”

Update — and Leverage — Your Org Chart

Simply gathering accurate data poses another post-merger challenge for law departments.

All of the documents related to the acquired company must be uploaded into a merged system, for example, and they must be made available to the appropriate employees.

Once the information is updated, Mercator’s Entica platform can create detailed and interactive corporate org charts. This allows users to visualize the full organization — which entity sits on top, what happens if entities’ locations are moved, what it would mean if an entity were liquidated.

Law departments at this stage should consider their portfolio of companies, looking for entities that could be merged. Some may see an opportunity for immediate savings.

“If you have two of your own entities in, say, France, and you just acquired a portfolio that has three other entities in France, there’s a case for rationalization,” Mercator’s Abdellatif says.

“Ask yourself: ‘Why do I have five entities in France? Do I actually need all of these for the activities I perform, and what are the cost and compliance implications of maintaining them?”

When companies neglect their org chart, it can also create long-term problems, according to Naturman.

“Especially if you’re a serial buyer and you’re buying companies, you may end up having a web of entities, and it just gets out of control and hard to manage,” he says.

This type of sprawl can create tax inefficiencies and prevent organizations from minimizing liabilities by housing them in carefully chosen entities within the organization’s structure.

“I don’t think enough of that planning happens,” Naturman says. “It’s often we’re brought in five years later to help, then they say: ‘Help us. It’s a complete mess. How do we reorganize ourselves? How do we get this under control?’”

Mercator’s Abdellatif adds: “Dormant entities often become problematic when overlooked during transitions or treated as ‘out of sight, out of mind.’ We frequently see cases where incomplete records or unclear responsibilities lead to surprise liabilities.”

“The solution is treating dormant entities with the same discipline as active ones,” he says, “maintaining accurate inventories, assigning clear ownership, conducting regular reviews, and ensuring professional oversight. This transforms them from hidden risks into manageable assets.”

Create an Impeccable Calendar

Onboarding an entity also means onboarding its deadlines.

Once a transaction is closed, detailed deadline calendaring is a key step for GCs. Critically, this step isn’t limited to deadlines related to the deal itself.

Staying on top of deadlines means understanding when, say, a customer supplier contract will expire, Naturman notes. Maintaining this focus is a key to successfully merging multiple entities.

“One thing I’ve seen over the course of my career is less diligence being done, or more targeted diligence,” he says.

Abdellatif notes that Mercator’s Entica system contains robust workflow, calendaring, and compliance capabilities, among its other features.

Mergers are a logistical exercise, he says, and the right technology can form the organizational backbone for a transaction to progress.

“Technology functions differently within each corporate environment — meaning it doesn’t always get used the same way,” he says. “To get the most value out of it, you need to make sure that its properly adapted to each specific environment.”

He adds: “When implemented thoughtfully, technology becomes more than just a system — it becomes the foundation that helps standardize processes, maintain compliance, and ultimately drive successful integration.”

Stay tuned for the next article in this series, where we’ll be exploring steps to consider during the negotiation and closing of a transaction. You can register for our webinar on these topics here.