Michael Allen

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. Michael Allen is Managing Principal at Lateral Link, focusing exclusively on partner placements with Am Law 200 clients and placements for in-house attorneys.

While associates are ecstatic for their first nominal raise in nearly ten years, the outstanding question remains: Who pays for these raises?

After Cravath bumped first-year salaries at large firms to $180K in early June, 89 other firms have matched. Of those firms, 49 increased salaries at all of their offices nationwide, and 35 increased salaries at offices only in major markets. A total of 5 firms limited raises to just New York.

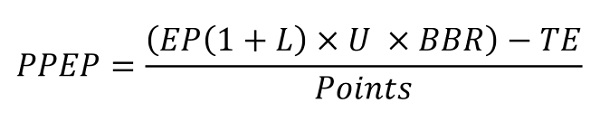

In the early ‘90s, David Maister wrote an article for the American Lawyer outlining the profitability model for law firms, where Profits Per Equity Partner are equal to the relationship between several variables or “levers,” with which firms have been constantly tinkering to maximize profitability. Chief among these variables are leverage (L), utilization (U), costs (TE), and blended billing rate (BBR).

In the past, firms have been able to pass increased costs on to clients by raising billing rates. But as billing rates continue to climb, we have seen general counsels push back.

The immediate fallout is fairly obvious. Firms with a large number of associates in markets that received salary increases will theoretically have diminished profits (among all profit-related metrics like PPP and PPL) because of increased costs.

Costs are not the only variable driving down profitability. As the divide between billing rate and collection rate continues to widen, profits decrease (source).

Productivity – the ratio between total billable hours and total attorneys, and analogous to U – has fallen in tandem. With U expected to decrease and total expenses expected to increase, it seems likely that firm profit margins will take a hit, unless firms are able to otherwise decrease variable costs such as office space, administrative support, marketing budgets, technology, and the like.

Billing Rate Progression

Not surprisingly, out of the total overhead costs, attorney salaries make up the largest percentage of expenses compared to any other group, and with the new Cravath scale we would expect this trend to rise. Most firm overhead is largely fixed: firms sign lengthy leases that can lock them in for over a decade; professional staff is vital to a functioning firm; tech and marketing are now a requisite and not a luxury for a full-service firm. Regardless, firms actually have been diligent about curbing expenses since the recession.

Overhead Expenses Detail

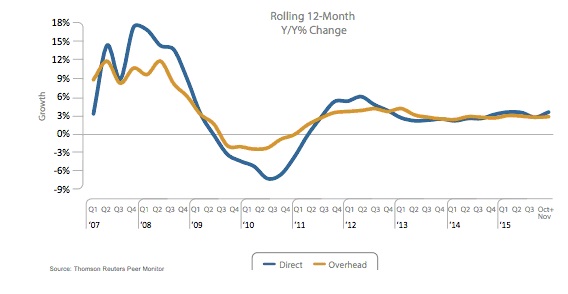

As you can see, both direct and overhead expenses have normalized well below the growth rates we recall before the recession. Expenses are largely static when adjusting for firm growth and inflation.

Expenses Growth

Because there are so few areas to cut further, and partner compensation is one of the few highly variable costs law firms have, partners are wary that the associate salary bump has an obvious target in mind – their share of year-end profits.

Partners have long benefited from a model that has generously rewarded business generation. A partner at a Biglaw firm can typically expect to realize between 25% and 33% of their portable book of business with diminishing returns to increased size. A partner with a $6 million book of business may personally bill under $1.5 million, but ultimately may collect over $2 million, and possibly much more, depending on the firm’s compensation formula.

It seems that the majority of the Am Law 200 law firms will pass their associate raises on to their partners. The very few firms with institutional business, such as Wachtell Lipton or Paul Weiss, whose clients are less price-sensitive for unparalleled service, will be able to pass along the costs to their clients by increasing billing rates over time. Indeed, Wachtell’s mysterious compensation system already compensates associates well above market value.

Firms with low leverage have been reluctant to match Cravath’s new standard. The reasons behind this are clear. On a macro level, associates at low leverage firms have less leverage when it comes to their value in the firm’s profit model. Large firms with high leverage like DLA Piper and Baker & McKenzie, who derive a much larger percentage of their gross from associates, would be crippled by an exodus of associates and are, in essence, forced to play ball.

Leverage by Firm Type

Highly leveraged firms also operate with a discrete understanding that there are very few partnership positions for their glut of associates. Consequently, they must keep their associates happy to keep lateral retention high. Firms with lower leverage can entice associates with the increased prospect of a partnership position, where they will reap the benefits of the existing compensation model.

Because associates have a high ROI, highly leveraged firms with high profit margins will face less pressure to redistribute the wealth from partners to associates. They will likely take a hit in Profits Per Partner, but they will try to keep their Profits Per Lawyer steady.

Leverage does not explain the entirety of each firm’s decision to match, and may be somewhat of a red herring for a more complex trend. The most interesting result of the salary wars was a clear demarcation between firms that have a revenue model that can support raises, and firms that don’t.

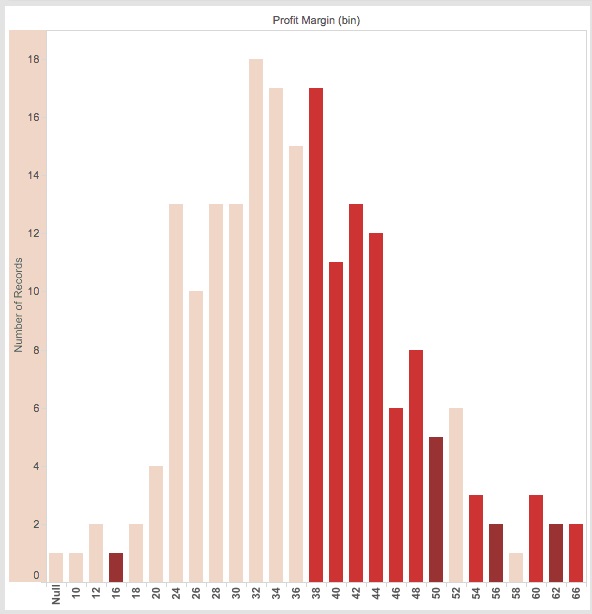

Firm Match by Profit Margin

Unsurprisingly, the division was drawn by the profit margins of the Am Law 200—for which leverage has a pronounced correlation. The above graph, stepped in three shades of red, represents the extent to which a firm matched. Pink denotes no match, red signals a major market match, and maroon a full match. Incidentally, the critical mass for propagating the new Cravath model occurred right around the mean.

Firms under the mean will have a hard time matching, but may implement the new scale if they start experiencing significant lateral losses (which may be too little, too late). Profitable matching firms will opportunistically poach the top associates from these firms by offering competitive compensation packages, potentially causing firm collapses – or at the very least, mergers.

At Lateral Link, we are expecting to see even more lateral movement from both associates and partners within Am Law 200 firms. We have already witnessed the shift to a candidate-driven market for associates, as well as an increased concern from partners who anticipate bearing the costs of these raises at year’s end. It’s clear from studying these models that there are ways of maximizing your year-end profits, and we are always available to consult on your individual situation.

![]() Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click ::here:: to find out more about us.