Managing client funds is one of the most critical responsibilities a law firm faces. Mismanaging trust accounts can lead to ethics violations, financial penalties, or even disbarment. That’s why a thorough understanding of trust accounting and the implementation of three-way reconciliation practices are non-negotiable.

In this post, we’ll walk through the essential three-way reconciliation process and explore how modern legal software helps law firms stay compliant, efficient, and audit-ready.

What Is Trust Accounting?

Trust accounting refers to the proper management of funds held in trust on behalf of a client. This typically occurs when a law firm receives an advance retainer or settlement funds that don’t yet belong to the firm. These funds are placed into a separate client trust account—often referred to as an IOLTA (Interest on Lawyers’ Trust Accounts) account.

The cardinal rule of trust accounting is simple: no commingling. Client trust funds must always be kept separate from the firm’s operating funds. Any earned fees, expense reimbursements, or withdrawals must be meticulously documented and only made when properly invoiced or authorized.

To ensure compliance, firms are expected to maintain detailed records for every transaction, including:

- The amount received

- The client associated with the funds

- The purpose of the deposit

- The dates and details of any disbursements

Legal-specific accounting software simplifies this process by automatically categorizing transactions and assigning them to individual client ledgers.

Why Trust Accounting Matters

The stakes for getting trust accounting wrong are high. Many state bars conduct random audits, and any discrepancies can result in disciplinary action. According to the 2025 Legal Industry Report, 49% of firms cite trust accounting as a moderate or significant challenge, and 61% report challenges with accounting overall. The complexity and compliance burden are real, especially for small or solo practices juggling multiple responsibilities.

The good news? With the right processes and tools in place, firms can turn trust accounting into a strength rather than a liability.

Three-Way Reconciliation: A Monthly Must

One of the most effective ways to maintain accurate trust accounting is through three-way reconciliation. This practice ensures the law firm’s trust records are accurate and aligned with actual bank balances. It involves cross-checking three key elements:

- Trust Account Bank Statement: What your financial institution reports

- Firm Trust Ledger: The internal accounting record of all trust activity

- Client Trust Ledger: Sub-ledgers showing individual client balances

The total of all client sub-ledgers should exactly match both the firm’s trust ledger and the adjusted bank balance. Any discrepancies, such as outstanding checks or bank fees, must be identified and documented.

The process should be conducted monthly, though some jurisdictions allow quarterly reconciliation. It should also be accompanied by clear documentation and sign-offs to satisfy audit requirements.

How Software Simplifies Reconciliation

Traditionally, three-way reconciliation was handled using spreadsheets and manual calculations, a process that is both time-consuming and error-prone. Today, legal accounting software like MyCase can automate much of this work.

With MyCase Accounting, firms benefit from:

- Auto-matched transactions to the trust bank feed

- Real-time client and matter balances

- Integrated trust payment workflows

- Instant reconciliation reports

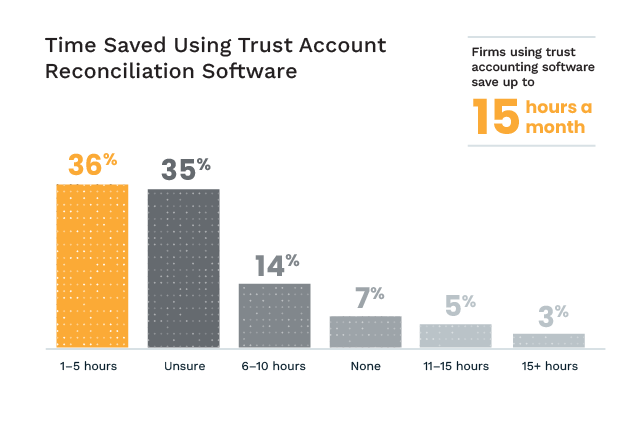

Data from the 2025 Legal Industry Report found that firms using trust accounting software save up to 15 hours per month. Specifically, 36% reported saving 1 to 5 hours monthly, and 14% saved 6 to 10 hours—a powerful endorsement for digital tools that reduce manual entry and improve compliance.

Best Practices for Trust Accounting & Reconciliation

To ensure your firm is compliant and efficient, follow these key trust accounting best practices:

- Separate Accounts: Use distinct accounts for client funds and operating expenses. For large or long-term matters, consider opening separate trust accounts.

- Document Everything: Always include a memo or reference for each deposit or withdrawal. Save receipts, client instructions, and invoices.

- Reconcile Monthly: Even if not required in your jurisdiction, monthly reconciliation is a best practice that ensures no errors go unchecked.

- Avoid Bank Fees: Ensure your trust account agreement does not specify service charges, overdrafts, or bounced check fees.

- Assign Responsibility: Delegate trust reconciliation to a specific person (or team), and require dual review for added oversight.

- Use Legal-Specific Software: Platforms like MyCase help reduce human error, streamline workflows, and automatically track compliance tasks.

Streamlining Trust Management With MyCase

Trust accounting can feel intimidating, but it doesn’t have to be. By understanding the basics, embracing three-way reconciliation, and using the right tools, firms can build trust with clients and regulators alike.

With software like MyCase, your firm can streamline compliance, reduce risk, and save hours every month, so you can focus on what matters most: practicing law. Want to see how you can transform your trust accounting with MyCase? Schedule a demo today.