5 Things About The 2022 Legal Industry No One Is Talking About

The overlooked nuggets from the latest Citi report.

Citi Private Bank and Hildebrandt Consulting LLC put out the annual Client Advisory report yesterday and covered a lot of ground (growth was up!) and made some predictions (growth won’t stay up!). The growth and the accompanying explosion in associate compensation as an expense this year are what most folks are buzzing about, but there’s more buried in this report.

Citi Private Bank and Hildebrandt Consulting LLC put out the annual Client Advisory report yesterday and covered a lot of ground (growth was up!) and made some predictions (growth won’t stay up!). The growth and the accompanying explosion in associate compensation as an expense this year are what most folks are buzzing about, but there’s more buried in this report.

So here are five takeaways for lawyers and the rest of the industry to consider going into next year.

1) It Continues To Suck To Be In The Am Law Second Hundred

Generative AI In Legal Work — What’s Fact And What’s Fiction?

There’s absolutely nothing wrong with being an Am Law second hundred firm. Clients will get excellent legal representation from these firms, especially those with a regional focus.

But the problem that comes up year over year is that the second hundred find themselves constantly crushed between nimble, high-end boutiques and traditional Biglaw monoliths. If a client has a matter, they can get great service from a small firm with lower overhead or take zero chances with the board by sending the work to an established name. It’s why we see these mergers taking second hundred firms into new first hundred firms.

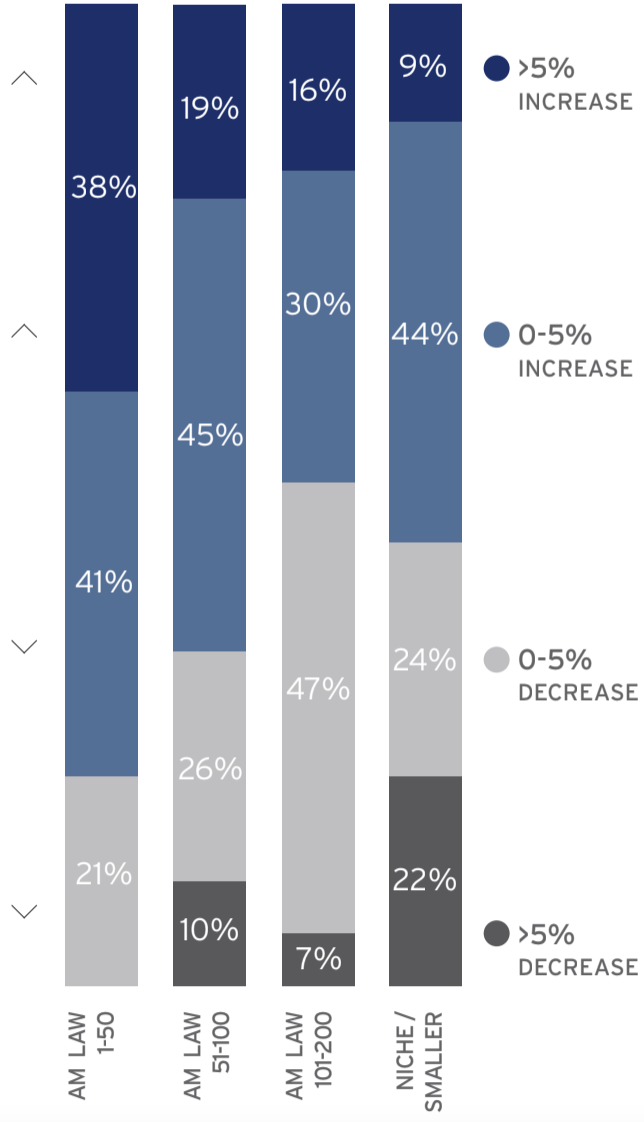

To the right is demand by segment comparing the first nine months of 2019 — when life was normal — to the first nine months of 2021. That’s the only segment to see a majority decrease in demand.

To the right is demand by segment comparing the first nine months of 2019 — when life was normal — to the first nine months of 2021. That’s the only segment to see a majority decrease in demand.

The second hundred, like most folks, did well during the pandemic. According to the report, “Am Law Second Hundred firms saw 2.5% demand growth and 10.7% revenue growth. While this demand growth trails the performance of larger firms, we would note that this is a stronger result than recent years, with a majority of firms reporting growth.”

Sponsored

Legal AI: 3 Steps Law Firms Should Take Now

The Business Case For AI At Your Law Firm

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

Is The Future Of Law Distributed? Lessons From The Tech Adoption Curve

It’s not great when the best thing they can say about your year was “could’ve been worse!”

And the overall trend as shown in this graph suggests this segment is going to go back to getting the short end of the stick on demand.

2) Everyone Knows M&A Is Hot… What About Labor & Employment?

We get it, everyone wants M&A right now. But look at L&E over there in the corner.

Sponsored

Navigating Financial Success by Avoiding Common Pitfalls and Maximizing Firm Performance

Generative AI In Legal Work — What’s Fact And What’s Fiction?

Walgreens stole $4.5 million from its workers JUST LAST YEAR. A Starbucks just unionized. Labor attorneys have work cut out for them everywhere. But the work is fee capped in some jurisdictions and that makes it hard for some firms to make headway in this field. Top firms have a hard time nuking their own billing schedule to get in on this work. Which is actually good for second hundred firms, by the way! Still, it’s a rough road.

3) Legal Secretaries Are Screwed

Throughout my career I was blessed with great legal secretaries. There used to be schools designed for the sole purpose of training folks — at the time exclusively women — to take dictation, touchtype at high speed, handle billing, screen calls, and keep on top of schedules. But as technology advanced, the staff role has given way to just discounting the time the associate spends making copies.

Good heavens that’s a stat! 93 percent of those polled are going to cut secretaries or keep them as is. And don’t get to sentimental over that 10 percent… firms who would otherwise let go their secretaries hold on when they have a good economy and the money to spend. Staff layoffs hit every time the economy takes a dip and when it does, that 10 percent are going to join the other 83.

Which is tragic since firms should be making these cuts during economic booms instead of busts to allow secretaries to find new jobs, but no one listens to my HR opinions.

4) Firms Are Getting Out Of Debt And Into Partner Buy-Ins

While the economy boomed, firms didn’t know that was going to happen. So they spent the pandemic weaning themselves off bank-provided credit and relying more on partner capital contributions.

We have also seen the industry raise the ratio of partner paid-in capital to net fixed assets in anticipation of continuing investments in office space, technology and practice expansion. Fixed asset spending by the industry was rising until 2020, when the COVID-19 pandemic introduced a pause. We now see many firms examining their capital spending plans for the next three to five years to determine how much capital they need to raise for the firm they intend to be.

Hey, maybe firms will be more eager to bring on equity partners if only for the cash.

5) China Will Kill Us All

Who’d have thought building ghost cities to juice GDP would backfire?

International firms rely on China for a large chunk of revenue and… that’s not looking great:

China is likely to see an economic correction as well, falling from a projected 8% growth in 2021 to a forecast of 4.5%, given Beijing’s need to manage its struggling domestic real estate giant Evergrande6 and the situation’s potential spillover effect.

This is a long time coming, of course. And the clampdown on Hong Kong is only making it worse.

Conclusion

But, yeah, there was growth and firms are paying associates more. Maybe I should’ve made the whole story about that.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.