The first installment of The General Counsel Report 2025 reads like something Indiana Jones dusted off from an ancient tomb. A relic of a long, lost civilization known as the In-House Lawyers, circa the summer of 2024.

The report, put together by FTI Consulting and Relativity based on interviews conducted by Ari Kaplan Advisors and surveys by Censuswide, gathered insights from corporate legal leaders from July to September 2024. It’s a slice of life detailing the hopes and fears of legal officers concerned about heightened regulation, the growing importance of ESG initiatives, and navigating investigations.

[QUIZ] Unlock More Time In Your Day With A Smarter Workflow

See how much time your firm could be saving. Use our free law firm time savings calculator to uncover efficiency gains and take control of your day.

Seems as though they might have different concerns in February 2025.

A mere month into Trump II: Muskrat Love, the administration has moved swiftly to gut regulatory oversight, reverse diversity initiatives, and publicly retreat from white-collar criminal probes (except to prosecute companies for diversity, that is). While the report includes a few nods toward the risk of a changing environment, the respondents by and large describe a sliding doors world of continued cautious regulation in a steadily growing economy.

Regulation: From “Overload” to Open Season

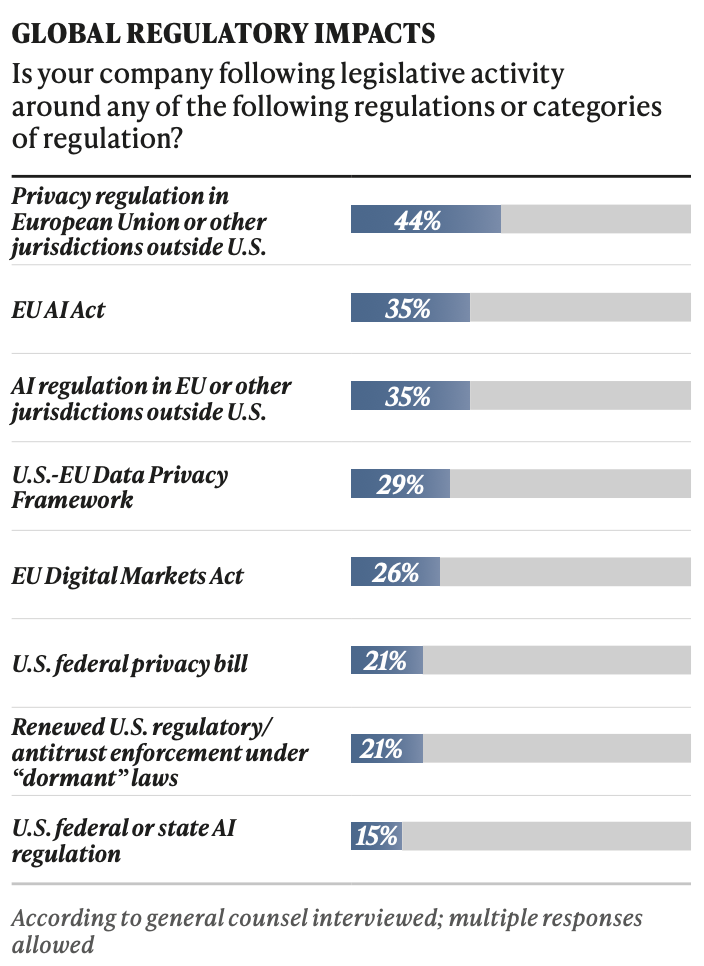

When surveyed last summer, 41 percent of GCs ranked regulatory compliance as their number one risk. While it’s the second year in a row that regulation topped their concerns, the figure still reflected a sharp increase from 30 percent the year before. Trump rolled back — or at least attempted to roll back, depending on your sense of the judiciary’s willingness to enforce the Administrative Procedure Act — 100 or so regulations on his first day. Since then, he hasn’t stopped with everything from environmental to labor to basic occupational safety getting the (attempted) ax.

Billables Are Not The Same As Cash Flow. Here’s Why That’s Important.

Findings from the MyCase 2025 Legal Industry Report.

Additionally, when asked about what areas of work have increased in volume, new regulations and laws requiring policy refreshes and headcount topped the list, with 74% listing this as an area of increased work. Comparatively, the quantitative survey asked respondents to rank the top five areas that require the most time from legal departments; 26% included compliance monitoring and 25% said regulatory investigations.

But all this regulatory chaos presents its own risk. Policy refreshes don’t just mean new rules — they also mean deleting the old ones at breakneck speed. Any legal team that prepped for an onslaught of new regulations faces the new compliance nightmare of dealing with evaporating rules.

Blunting these concerns is the continued existence of the overseas markets committed to running 21st-century economies even while Trump wants to party like it’s 1899 when child labor was booming and tariffs fueled America’s routine financial panics.

ESG: From Compliance Risk to Political Target

Environmental, Social, and Governance compliance rated as a top-five legal risk for respondents, with more than 35 percent placing it in the top tier. According to the report many expected the area to remain a complex, moving target with investors maintaining pressure upon companies to live up to their pledges while noting some nascent pushback.

As a result, there is no way to fully ensure readiness. Another general counsel explained, “We are getting better and continue to hire outside specialists in recognition of the need to improve. Most organizations are prepared…However, we are starting to see a backlash against ESG…if you recognize something other than a commercial or economic value, you are not necessarily acting in the best interests of your shareholders.”

That pushback since transformed into a tidal wave, with Trump and his allies not only railing against domestic ESG — particularly when it comes to diversity — but hinting at cracking down on European-driven initiatives. Back in the summer of 2024, in-house counsel worried about getting grilled over greenwashing or inadequate disclosures and now they’re falling all over themselves to publicly declare their rejection of the most modest of diversity commitments.

It’s an inversion of corporate risk. Companies that previously feared liability for not doing enough on ESG now risk scrutiny for doing too much.

It was already a moving target, now it’s more Whac-a-Mole as law departments face corporate governance strategies that were best practice six months ago becoming potential legal liabilities.

Investigations: The Unexpected Pivot

The report identifies internal investigations as one of the most time-consuming and high-risk areas for legal teams. Nearly one-third of GCs reported a rise in disputes and civil litigation, while 35 percent flagged internal investigations as the top trigger for legal action.

But the anticipated drivers of these investigations — whistleblower complaints, regulatory scrutiny, fraud — are being reconfigured under the new administration. White-collar criminal enforcement barely made it past the loading screen of Pam Bondi’s tenure as Attorney General. Corporate fraud and foreign bribery no longer warrant DOJ bandwidth, though companies may have to buckle up for federal probes to defend how every Black employee on the payroll got their jobs.

The General Counsel Report 2025 isn’t much of a roadmap at this point as much as a faded treasure map leading straight into a booby-trapped regulatory hellscape. But it does highlight that the biggest challenge for in-house counsel right now is agility. Between the radical shift in priorities and the administration committing to a speedrun to reverse decades of regulatory framework (courts and statutes be damned), corporate legal has to move fast. While slashing regulation might sound like it takes a load off corporate legal, the sudden absence of guardrails is just as much a legal migraine — especially when the rest of the world isn’t racing to see how fast they can torpedo corporate governance.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.