The Thomson Reuters Institute and Georgetown Law’s Center on Ethics and the Legal Profession released their annual State of the U.S. Legal Market report today, and the good news is that law firms are absolutely crushing it. Profits are up. Rates are up. Demand surged in 2025 at levels the industry hasn’t seen in more than a decade. The Am Law 100 is printing money, midsize firms are having a moment, and everyone is congratulating themselves for their “resilience.”

Have we ever seen numbers like these before? *Laughs nervously in Lehman Brothers*

The legal industry has surged like this before — in 2007 before the Global Financial Crisis (GFC), and in 2021 before an inflation crunch — and each time, firms that mistook altitude for stability found themselves falling furthest when conditions shifted.

First of all, it seems like terminal lawyer brain to initialize the recession. The term only comes up three more times! But more importantly, the market’s present exuberance coincides perfectly with past crashes. Take a moment to brush off that resume.

The report opens with an extended metaphor about the formation of the Himalayas, crediting tectonic forces for sending peaks soaring into the atmosphere, while noting that “the very forces creating today’s peaks are simultaneously undermining the ground beneath them.” For the legal market, this translates to a market heavily reliant on legal problems generating hefty profits in the short term and leaving lawyers unemployed in the medium term. It’s the regulatory whiplash and random trade wars and all around geopolitical instability. That’s why the market saw peaks in both transactional work and counter-cyclical work, a feat the report describes as “highly atypical, again except for in periods of severe market disruption.”

If chaos is a ladder, the Trump administration is a mountain range and the legal market is high enough to start getting delusional from oxygen deprivation. Unfortunately, once you hit the summit, there’s nowhere to go but down, passing the corpses of 2007 and 2021 along the way.

Throw into this unstable business climate the fact that firms are pouring money into artificial intelligence with the enthusiasm of a tech bro who just discovered ketamine. Law firms increased technology spending by nearly 10% in 2025, racing to deploy AI tools that can draft briefs and analyze contracts in minutes instead of hours. At the same time, they increased lawyer compensation by 8.2% and grew headcount by 2.9%. At the same time, some 90% of all legal dollars still flow through standard hourly billing arrangements.

Spending more to do work in less time while getting paid by time. The report diplomatically describes this as creating “an almost absurd tension.” It’s why the billable hour should get a serious rethink in 2026… but probably won’t.

The result is a standoff that would be comical if the stakes weren’t so high. Client interviews reveal that corporate legal departments want their outside law firms to propose innovative billing solutions that incorporate AI’s efficiencies, while law firms complain that clients still evaluate everything by converting it back to hourly rates. Why spend months developing a sophisticated value-based pricing model when the procurement team will just divide the total by estimated hours and compare it to last year’s rates?

This is why legal can’t have nice things.

And so rather than figure out a new billing solution, clients are busy figuring out how to cut costs. Why move to value-based billing when leaning on AI-optimized hours gives clients an easy place to nitpick?

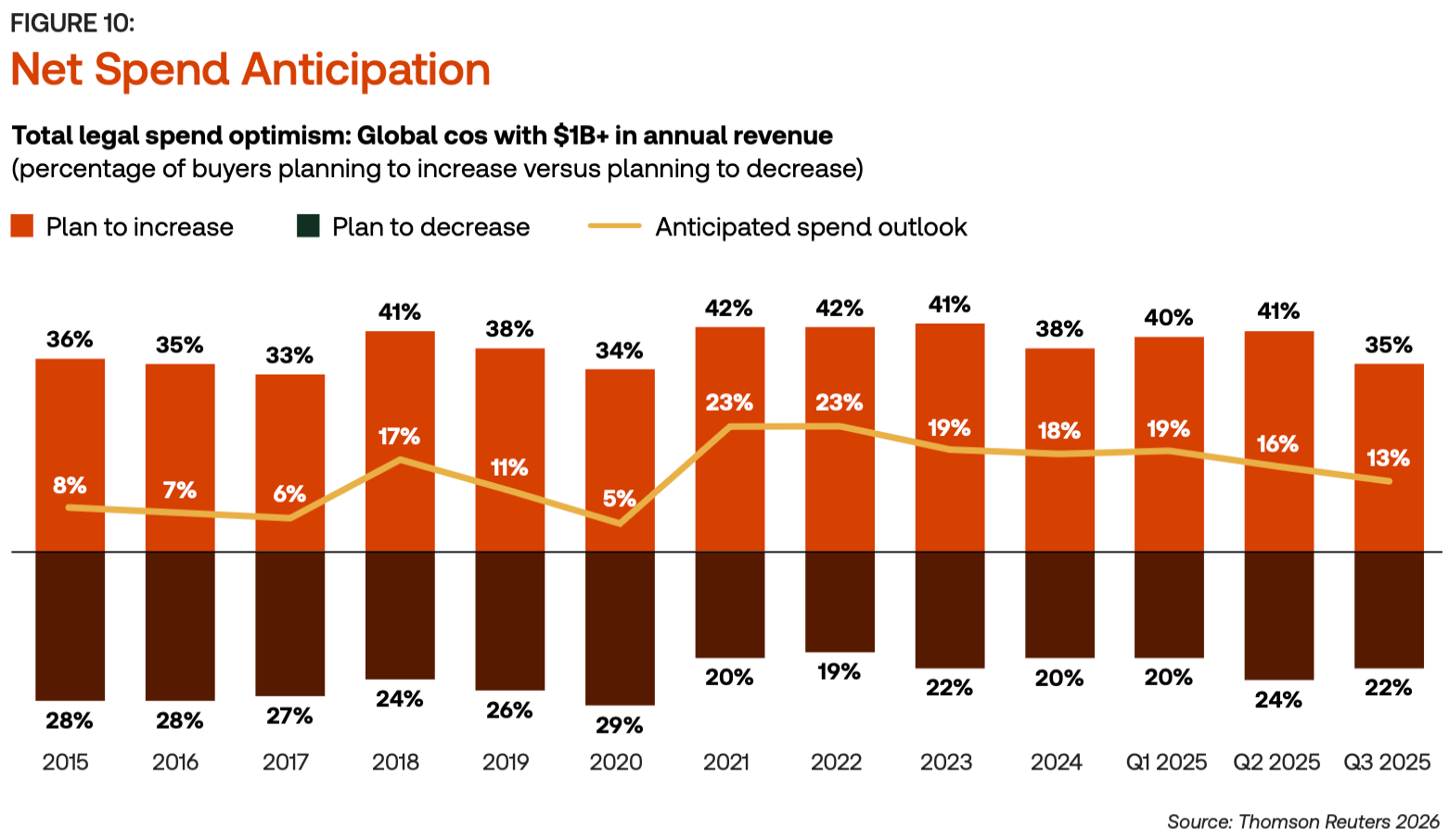

Spending going down right when law firm costs are going up? Sounds troubling.

Thomson Reuters Market Insights research calls this phenomenon a client value squeeze, and it’s becoming a major factor behind these constrained spending choices inside corporate legal departments. Even as 86% of GCs say they believe they are making significant contributions to organizational objectives, nearly 90% report that resource limitations are preventing them from delivering the level of strategic impact their organizations expect.

OK, why didn’t we abbreviate this? You invent a new term and don’t give it the “CVS” treatment?

The crucial insight here isn’t that there may be less legal work on the horizon — if anything, the complexity and chaos guarantee continued need for legal services. Instead, it’s that clients are being forced to make increasingly brutal choices about which firms get their limited dollars.

The math isn’t complicated. When Am Law 100 lawyers cross the $1,000/hour threshold while everyone else averages around $600, GCs start making different choices. The report calls this “mobile demand.” Normal people might call it “shopping around.” In any event, between high costs and technology narrowing the gap between what big and small firms can pull off, clients see more value at lower price points.

Clients actually spent less per hour on average legal services in 2025 than in 2024. This is despite firms raising rates 7.3%. Pretty clear evidence that rate hikes are pushing work downstream.

Midsize firms surged ahead with nearly 5% demand growth in the latter half of the year while the Am Law 100 couldn’t crack 2%, resulting in the largest percentage point-spread gap in demand between the top and bottom segments since the GFC. For much of the year, the Am Law 100 actually contracted while smaller firms captured all the growth. Indeed, top firms needed the third quarter’s explosive surge just to crawl into positive territory for the year.

There’s the GFC again, which still sounds like an ominous Roald Dahl character.

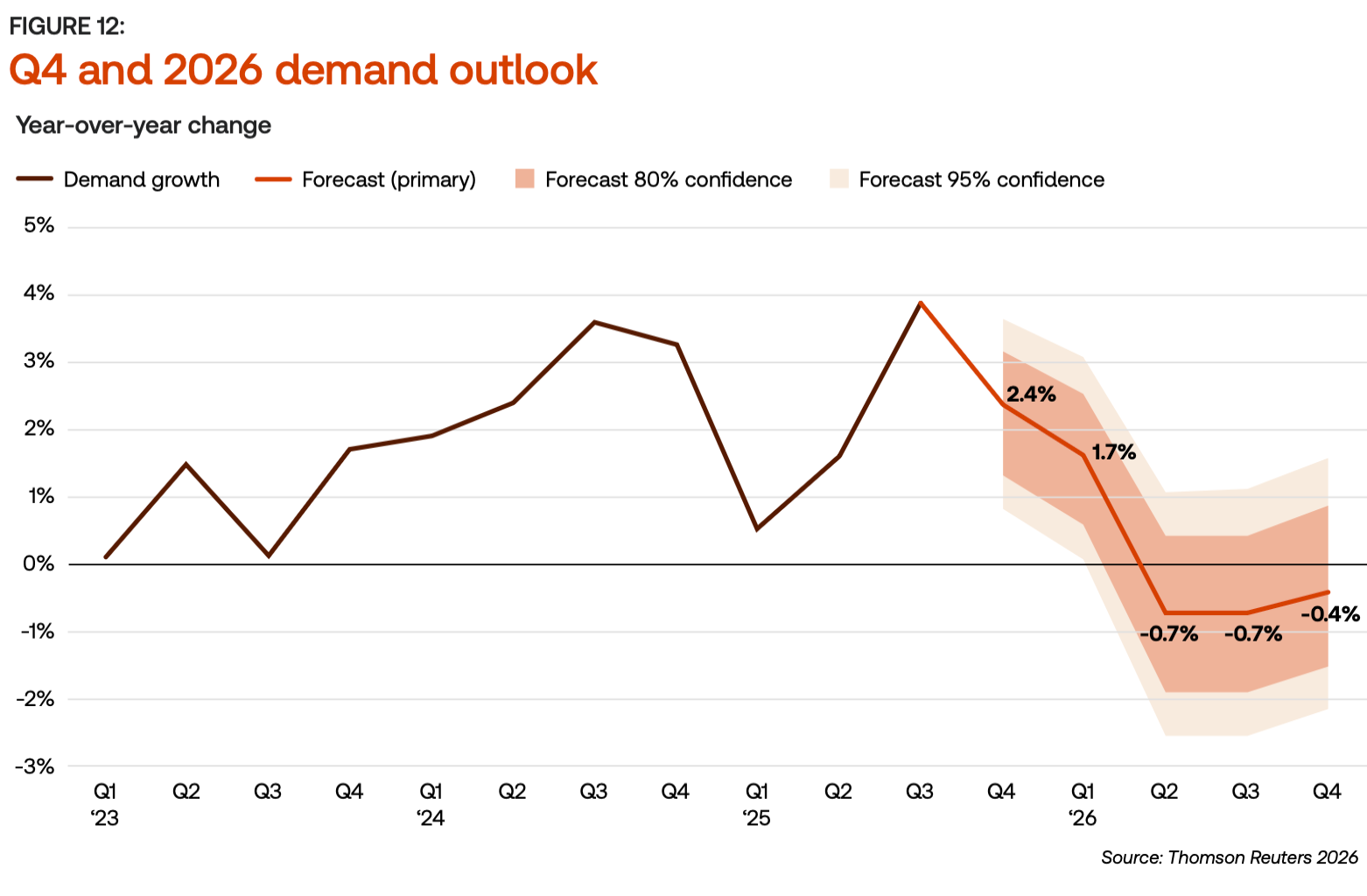

But while the report forecasts continued need for legal services amidst the chaos, it does see that need shrinking too:

Law firms are doing great because the world is on fire, AI is poking holes in their pricing model, and clients are running out of patience. That’s not a golden age; it’s a sugar high. And history suggests the crash will come right after everyone finishes congratulating themselves for surviving the last one.

And here’s the part that should really keep Biglaw up at night. After the 2008 financial crisis — sorry… the GFC — corporate legal departments absorbed laid off talent and used this newfound talent to get stingier with firms. “Suddenly GCs had former Big Law lawyers on staff who knew exactly how firms made up their bills, which matters required senior attention, and what work could be done for a fraction of the price,” the report notes. This rewiring of the firm-client relationship played a key role in the rise of absurd billing guidelines and heightened all-around scrutiny.

If this comes to pass again, corporate legal departments will also come armed with AI tools capable of transforming every invoice discussion into a financial colonoscopy. And their rebound hires might be able to use other AI products to move in-house all that work that once required the brute force of a large firm. A round of layoffs that give clients more outside counsel refugees could, at this point, tilt the balance of power irrecoverably toward clients.

So enjoy the view from the summit! Maybe all this mountaineering will come in handy when firms have to open their new Greenland offices.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter or Bluesky if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.